U.S. associated natural gas production will likely grow through 2050

Data source: U.S. Energy Information Administration, Annual Energy Outlook 2023 (AEO2023)

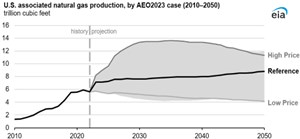

Note: Shaded regions represent maximum and minimum values for each projection year across the AEO2023 Reference case and side cases.

In our Annual Energy Outlook 2023 (AEO2023), natural gas production from oil formations, known as associated natural gas, grows across most cases through 2050, continuing a long-term trend. In the AEO2023 Reference case, we project that associated natural gas will account for approximately 20% of total U.S. natural gas production over that period, and we examined cases in AEO2023 where it makes up as much as 32% of production.

In our AEO2023, we explore long-term energy trends in the United States and present an outlook for energy markets through 2050. We use different scenarios, called cases, to understand how varying assumptions impact energy trends. The AEO2023 Reference case, which serves as a baseline, or benchmark, case considers only the laws and regulations adopted through mid-November 2022, including the Inflation Reduction Act (IRA).

Associated natural gas has historically been a relatively small proportion of U.S. natural gas supply. In 2010, associated natural gas production totaled 1.3 trillion cubic feet (Tcf), accounting for about 6% of domestic supply. By 2022, associated natural gas production had increased to 5.6 Tcf, or more than 15% of domestic natural gas supply.

The most productive U.S. oil-producing region, the Permian Basin (in the Southwest), accounts for most of the associated natural gas produced in the United States today. In the AEO2023 Reference case, we project that associated natural gas production in the Southwest will continue to grow, from 4.4 Tcf in 2025 to 4.9 Tcf in 2050, accounting for approximately one-third of associated natural gas production growth in the United States over this period.

Our projected growth in associated natural gas production is mainly driven by three trends:

- Rising oil prices support increased production from unconventional oil formations with significant natural gas volumes.

- Many unconventional oil wells are aging, and as these wells age, they tend to produce a higher ratio of natural gas relative to oil.

- Associated natural gas resources are becoming more economical, driven in part by provisions in the IRA, which creates penalties for venting and flaring methane and encourages producers to capture more natural gas from oil formations.

We project that associated natural gas production will increase from 7.2 Tcf in 2025 to 8.8 Tcf in the United States by 2050 in the AEO2023 Reference case. In the AEO2023 High Oil Price case, associated natural gas production peaks at 13.6 Tcf in 2035, accounting for 30% of the total domestic natural gas supply. By contrast, in the AEO2023 Low Oil Price case, associated natural gas production falls to 4.2 Tcf by 2050.

Related News

Related News

- Woodfibre LNG receives BCEAO order to move floatel to site to house non-local workforce

- QatarEnergy, Exxon seek to remove contractor from Texas gas project

- Veolia, Waga Energy and ENGIE collaborate to develop renewable natural gas industry in France

- Congo Brazzaville becomes an LNG exporting country

- Fulcrum LNG to pair with McDermott, Baker Hughes for Guyana gas project

- EU approves law to hit gas imports with methane emissions limit

- Veolia, Waga Energy and ENGIE collaborate to develop renewable natural gas industry in France

- Hawai'i Gas selects Eurus Energy America, Bana Pacific for hydrogen and renewable natural gas projects

- TotalEnergies increases LNG deliveries to Asia with two new contracts

- Desert Mountain Energy Corp. initiates helium production

Comments