Opinion: What excites and worries LNG exporters in 2026

Opinion: What excites and worries LNG exporters in 2026

The year 2025 in the LNG sector will be one for the history books after production and exports of the super-chilled fuel smashed records and raked in billions of dollars in revenues across the global liquefied natural gas supply chain.

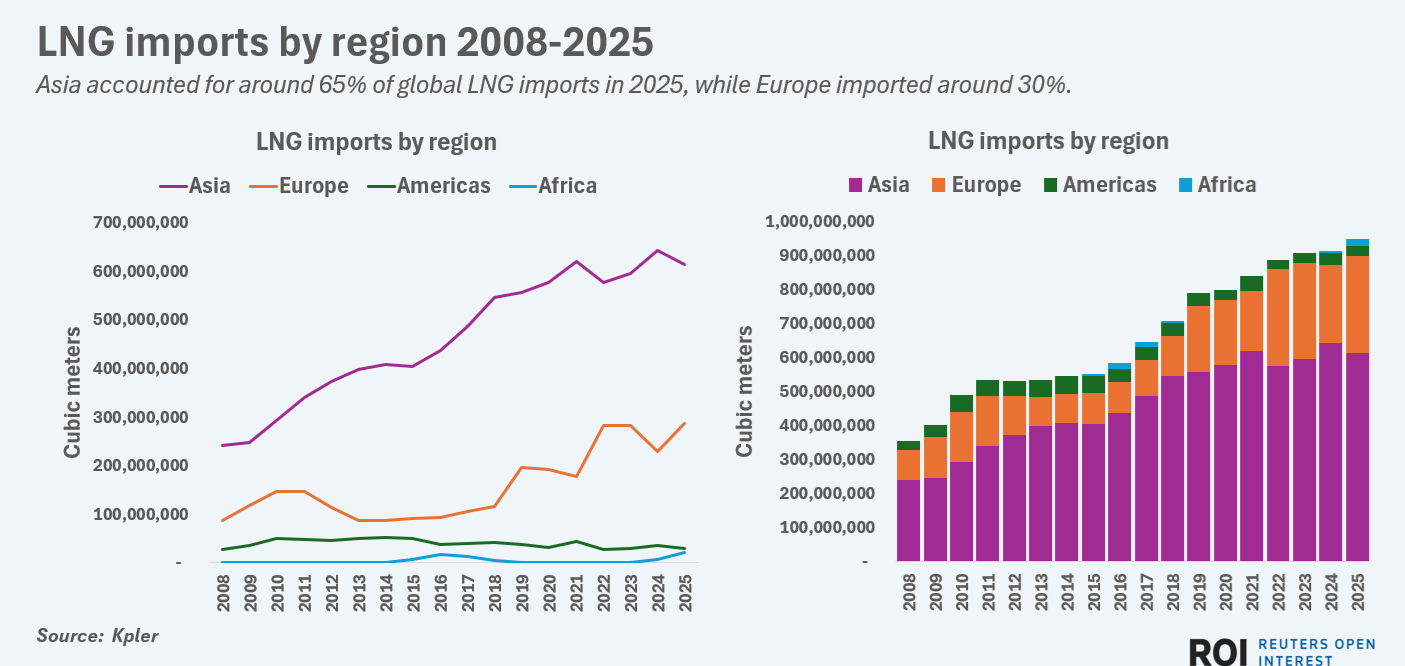

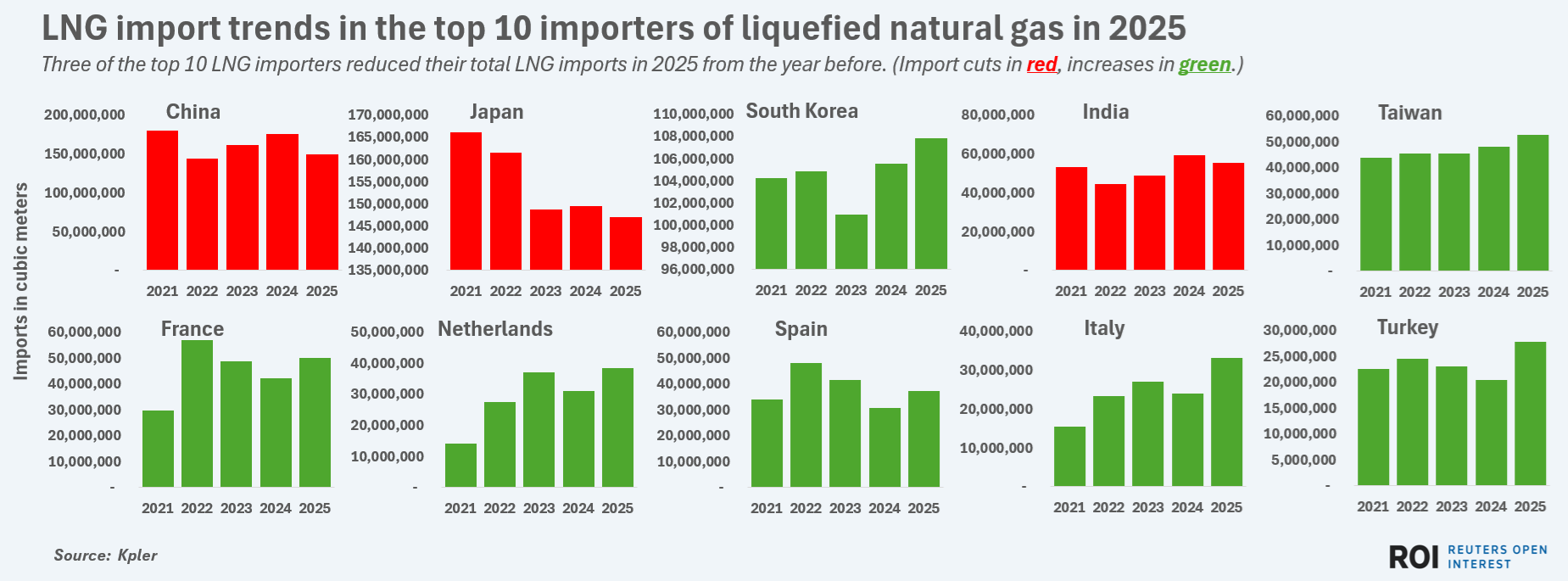

A 25% surge in LNG purchases by European countries was a key highlight and raised hopes among gas sellers that further growth in gas use in economies such as Germany, Italy and the United Kingdom is in store for 2026 and beyond.

On the other hand, lower imports by three of the five largest LNG buyers - all in Asia - have raised profit concerns, especially among exporters banking on selling the even greater volumes of LNG expected to hit the market this year.

As 2026 gets underway, here are some of the growth markets and soft spots that will be closely eyed by the LNG sector.

Europe’s staying power. The steep climbs in LNG purchases by several European countries in 2025 beg the question whether the region can sustain such a voracious appetite.

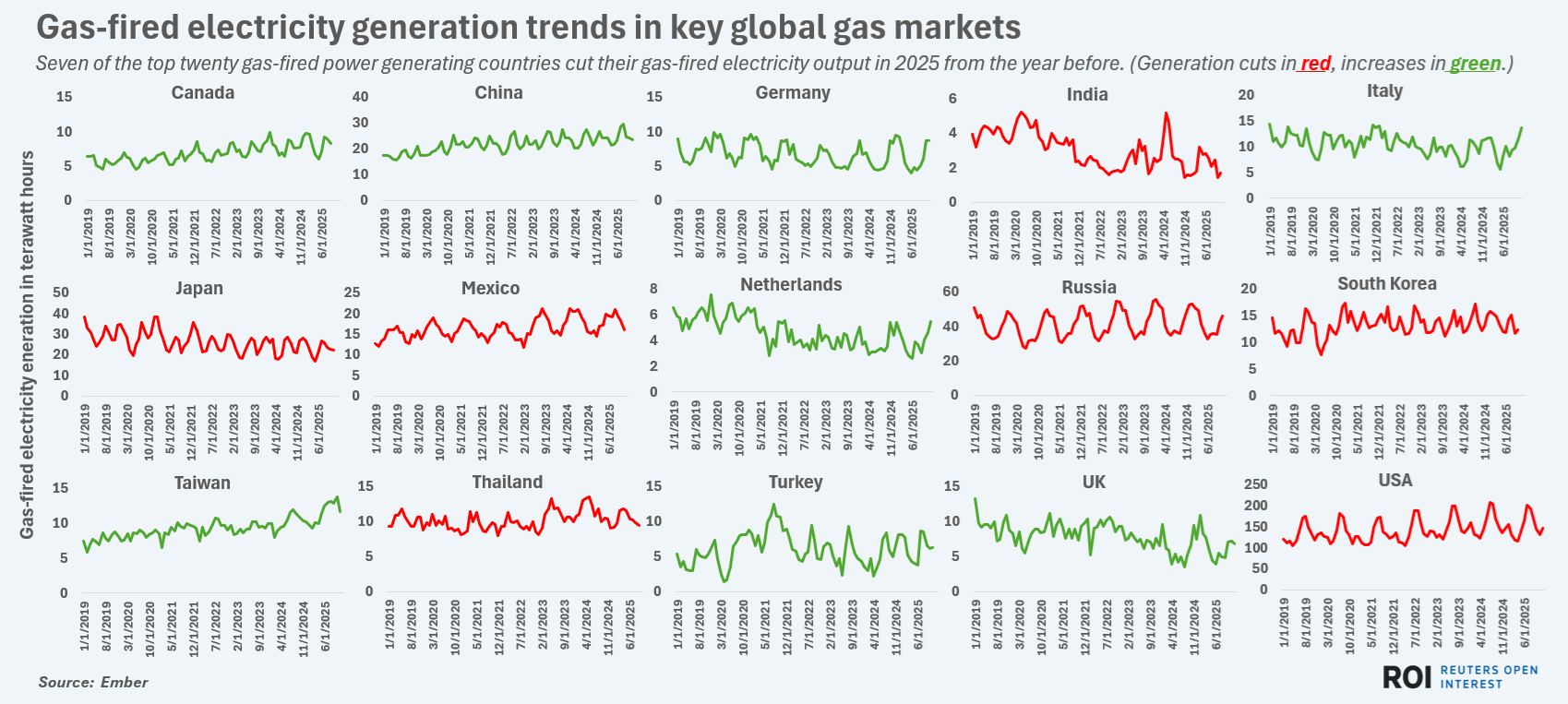

On the plus side, Europe's generation of electricity from gas-fired power plants posted its first annual rise last year since before Russia's invasion of Ukraine snarled regional gas flows in 2022.

Total European gas-fired electricity output during January to November was 1,009 terawatt hours (TWh), according to think tank Ember, up 3.4% from the same months in 2024 and the first year-over-year increase for that period since 2021.

Further increases in gas-fired power generation will obviously trigger further LNG import demand, especially in markets with shortages of alternative power sources.

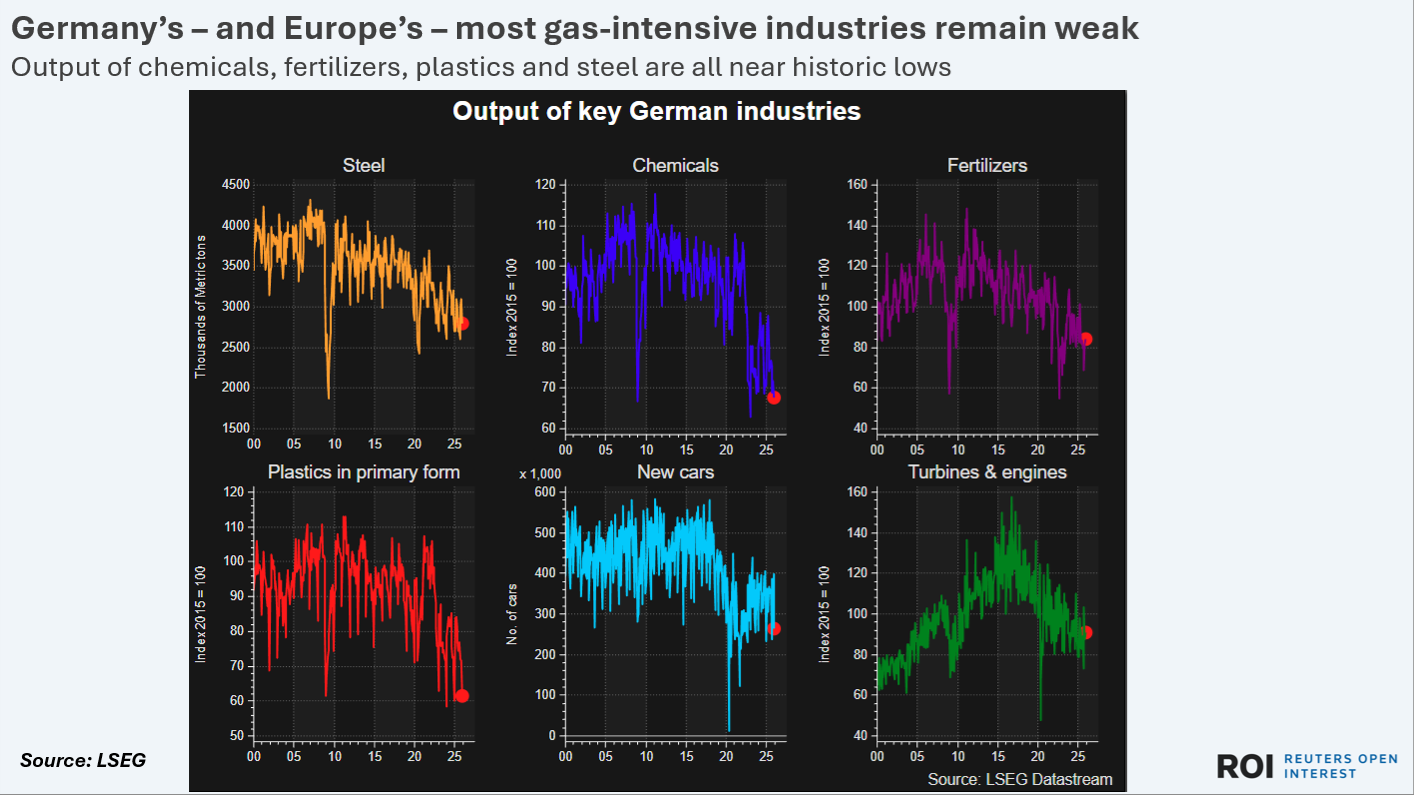

Europe's broader industrial economy, however, remains hobbled by weak manufacturing and consumer demand, and output among gas-intensive sectors such as chemicals and fertilizers remains near historic lows in top regional producer Germany.

Until a synchronized upturn in consumer and business activity takes root, it's likely that Europe's overall demand for natural gas may remain patchy, which may cap any further increases in LNG import interest over the near term.

Another question for LNG exporters is whether Europe's LNG purchases in 2025 were artificially inflated as several countries attempted to narrow their trade gaps with the United States during trade talks with the Trump administration.

European imports of LNG from the U.S. last year jumped by close to 60% from 2024 levels, data from commodities intelligence firm Kpler shows.

That outsized jump in U.S. purchases - well above the increase in Europe's total LNG imports - suggests the region may have been trying to curry favor with President Donald Trump as European and U.S. policymakers discussed trade deals.

With international focus now turning more to geopolitical concerns - such as the U.S. interest in acquiring Greenland - it is possible that European countries may prove less keen to please President Trump in 2026.

If that's the case, volumes of U.S. LNG imports aimed at reducing trade deficits in 2025 may get curbed in 2026.

Asia’s plateau? LNG exporters also have questions about the state of demand in Asia, which accounted for around 64% of all LNG imports last year, data from Kpler shows.

Total shipments to Asian buyers last year were just over 613 MMm3, marking a nearly 5% fall from 2024.

While a 5% volume slip was not much of a concern through 2025 given the steep growth in sales to Europe, LNG exporters will be anxious if Asia's overall appetite remains weak this year and Europe's buying pace also slows.

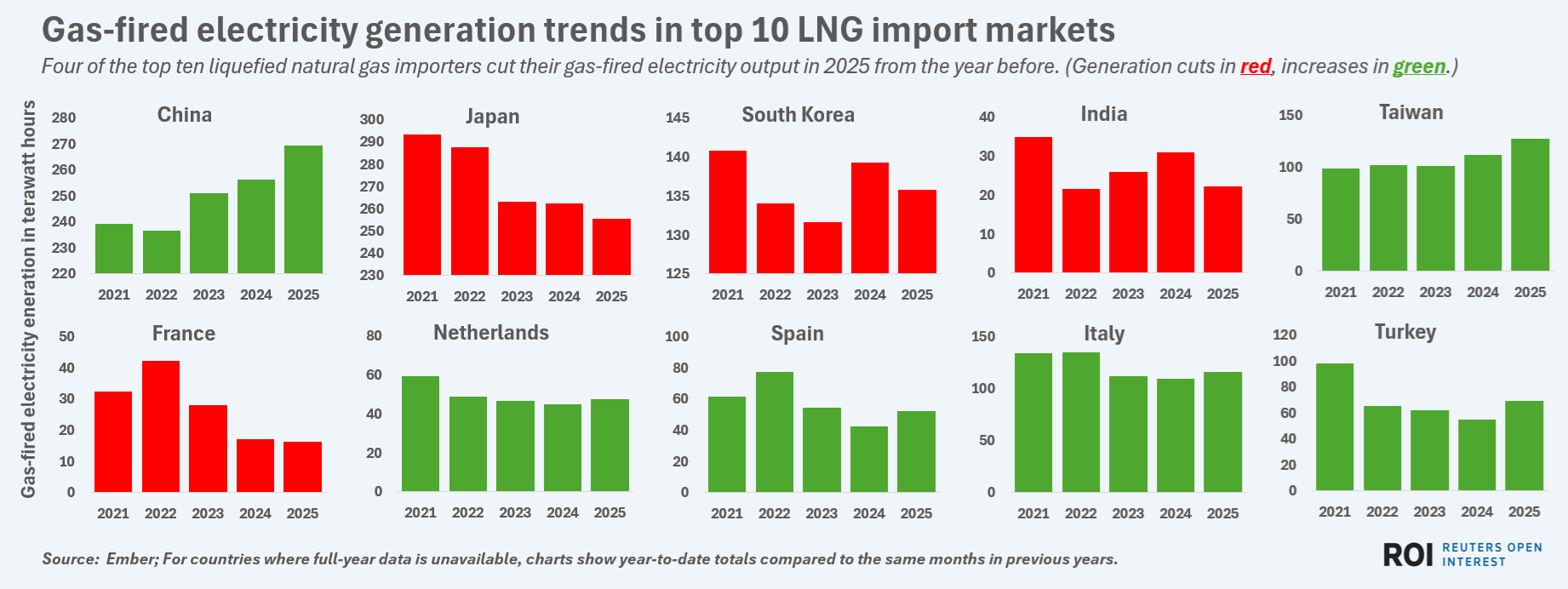

The top two overall LNG importers - China and Japan - registered LNG import cuts of 15% and 2% respectively in 2025.

The synchronized dip in imports by such critical markets will remain a cause for concern in 2026, especially if China's economy remains sluggish and trade relations with the United States and other markets remain chilled.

Rapidly expanding renewables power generation in China and steadily recovering nuclear power generation in Japan are further causes for concern as those power sources squeeze gas out of generation mixes.

LNG purchases by number four importer - India - also dropped by 7% last year, yet another source of worry among LNG exporters who had hoped India would be a steady growth market.

Higher global gas prices have resulted in a steady decline in gas-fired electricity generation in India so far this decade, also bringing a sharp slowdown in spending on gas distribution and storage infrastructure.

Bullish forecasters argue the steady swell in planned LNG exports will drive global prices lower and reignite demand for the fuel in fast-growing but cost-sensitive economies like India, Pakistan and Bangladesh.

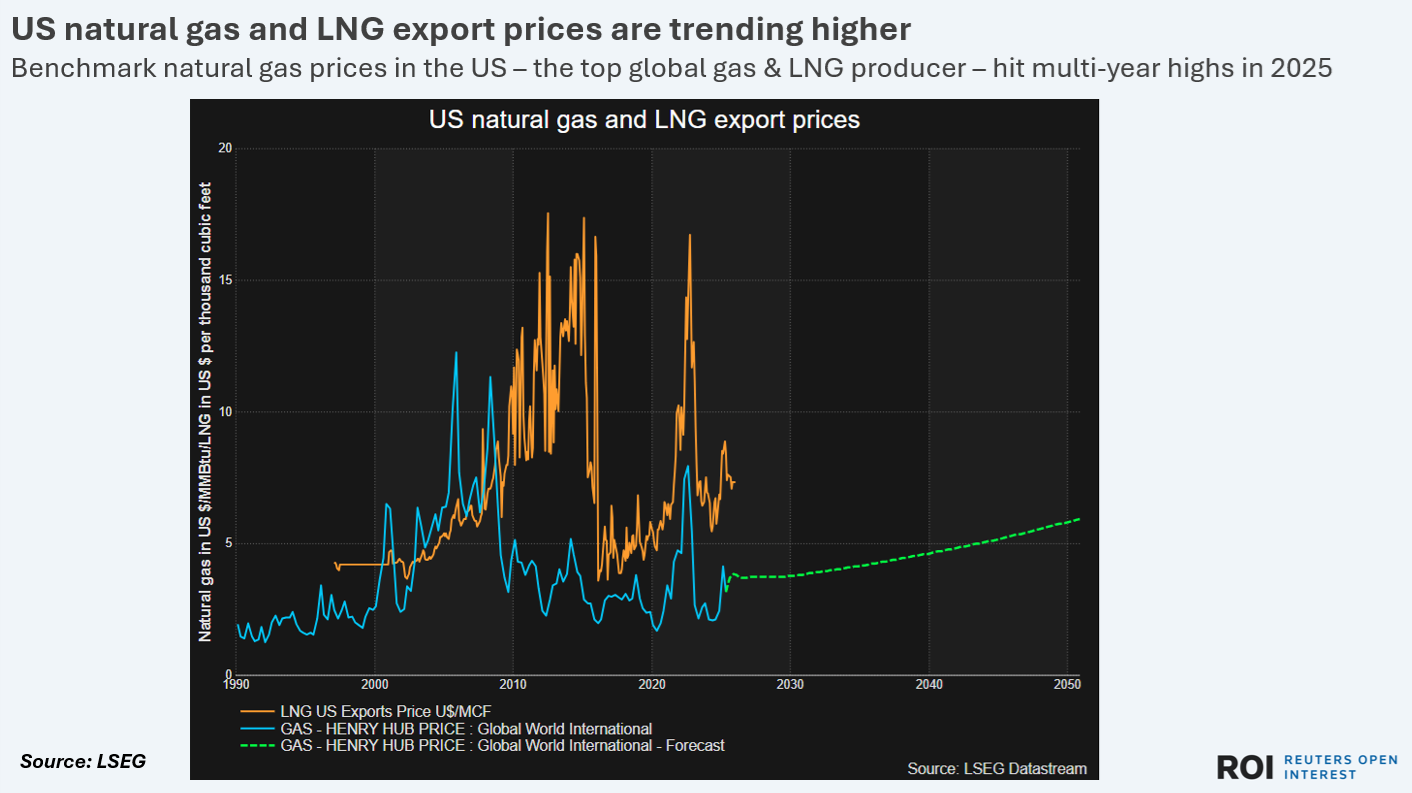

They may be right, but with benchmark natural gas prices near three-year highs and rising in the United States - the top global gas producer - it may be hard for LNG exporters to drive sale prices lower over the near term.

That may leave LNG exporters in 2026 focusing on already established markets, struggling in Europe to grow sales much from last year's levels and hampered in Asia by patchy demand as China's economy struggles for growth.

The opinions expressed here are those of Gavin Maguire, a columnist for Reuters.

Related News

Related News

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments