Opinion: U.S. LNG exports will shrink if margin squeeze intensifies

By Ron Bousso

Soaring U.S. natural gas prices are eroding profit margins for the nation's LNG producers, a trend that could deepen in the coming years, forcing exports to drop as global competition heats up.

U.S. benchmark Henry Hub gas prices spiked on Wednesday to their highest level in three years at over $5 per million British thermal units (MMBtu) for January delivery thanks to the combination of cold weather across the U.S. Northeast and a sharp rise in feedstock demand from liquefied natural gas (LNG) plants.

At the same time, an abundance of global LNG, mostly due to new U.S. supply additions, has pushed prices lower in big demand centers in Asia and Europe.

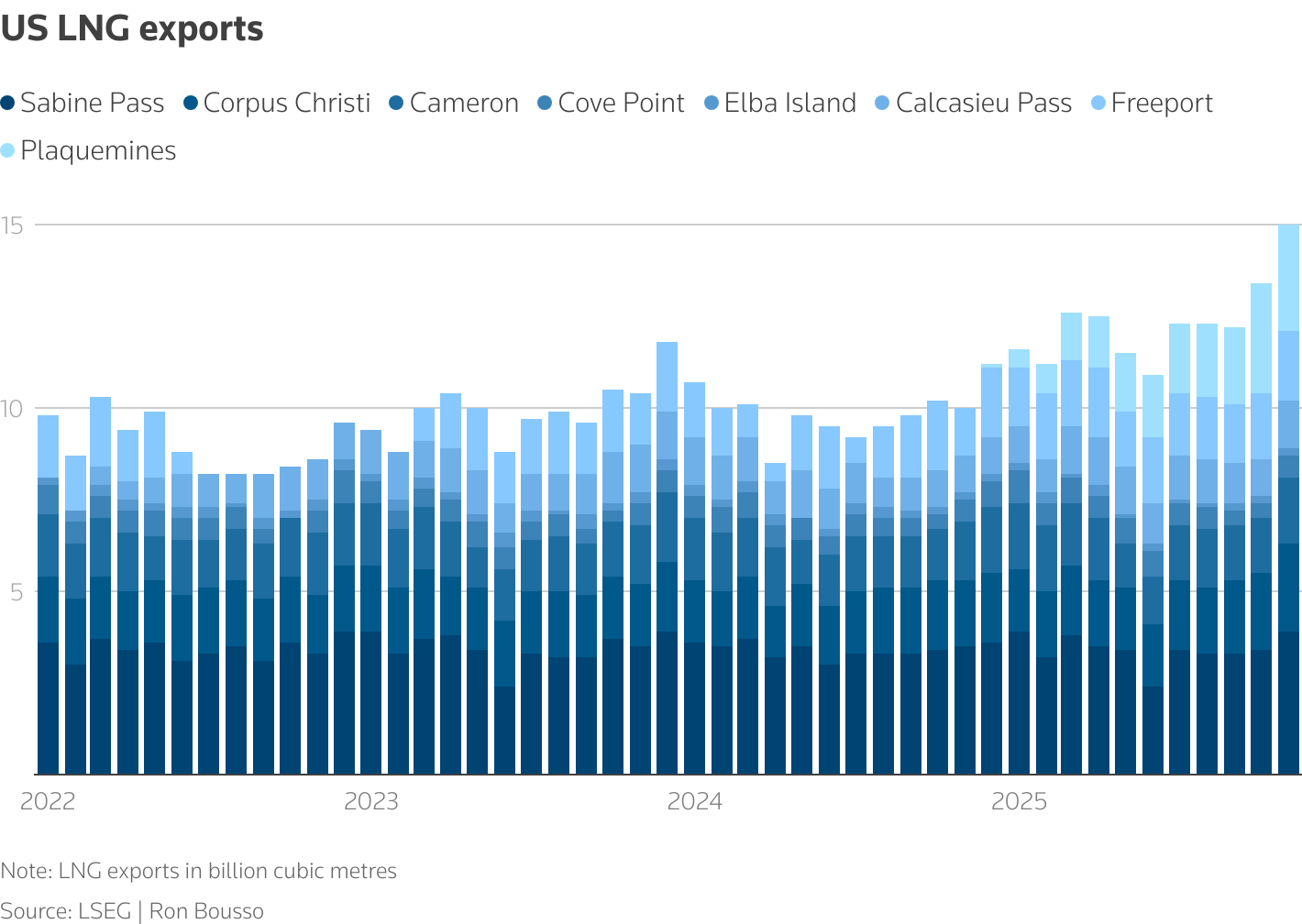

The U.S. became the world's biggest LNG exporter in 2023, surpassing Australia and Qatar. Exports from its eight main LNG terminals hit a record 12 Bm3 in November, a 20% rise from a year earlier, according to LSEG data.

Europe felt the biggest price impact, as it absorbs 65% of U.S. exports. Benchmark European TTF gas prices fell below €30 euros per megawatt hour (MWh) in recent days, hitting their lowest since April 2024.

The effect was magnified by weaker Chinese imports, which are set to fall to around 65 MM tonnes this year, their lowest since 2022, according to data from commodity analysts Kpler.

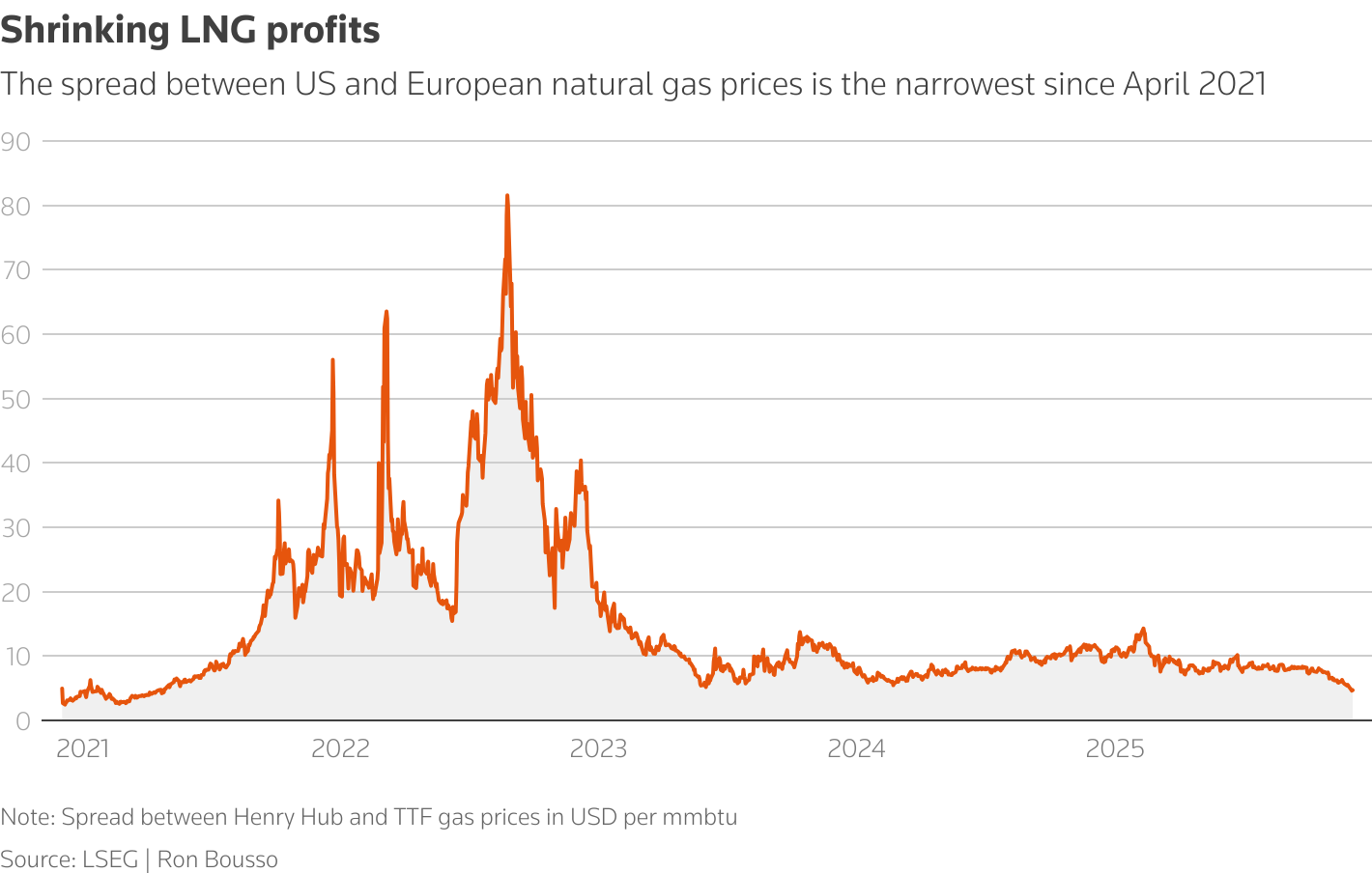

As a result of the dynamics on both sides of the Atlantic, the spread between Henry Hub and TTF prices has shrunk to around $4.70 per MMBtu, the slimmest since April 2021, according to LSEG data.

This is squeezing the profit margins for U.S. LNG exporters.

"U.S. LNG has made outstanding margins since late 2021, but those margins have come back to more normal levels now as the market has stabilized and new LNG capacity starts coming online," said Saul Kavonic, head of energy research at MST Marquee.

These margins now risk dropping below normal levels. Many U.S. LNG export contracts will be out of the money if the Henry Hub-TTF spread drops below $4 per MMBtu. And if margins fall below $2, representing LNG production costs, operators will almost certainly have to reduce production, according to Kavonic.

No LNG output cuts…for now. On the one hand, this suggests that production is unlikely to be curtailed next year as spreads are very unlikely to breach the $2 level. But that could change in 2027 and 2028 when more global supply comes onstream, mostly from the U.S. and Qatar.

Between 2025 and 2030, new LNG export capacity is expected to grow by 300 Bm3y, up 50% from 2025 levels, according to the International Energy Agency.

Around 45% of the capacity will come from the U.S., which has accounted for more than half of total additions of 390 Bm3y of capacity since 2019, according to the IEA.

Capacity is poised to grow further in the coming months with the Golden Pass terminal, owned by Exxon Mobil and QatarEnergy, and Cheniere's Corpus Christi expansion.

And this exceptional growth is not slowing down.

A total of 83 Bm3y of new U.S. LNG projects got the green light for development between January and October 2025, making it a record year for final investment decisions, according to the IEA.

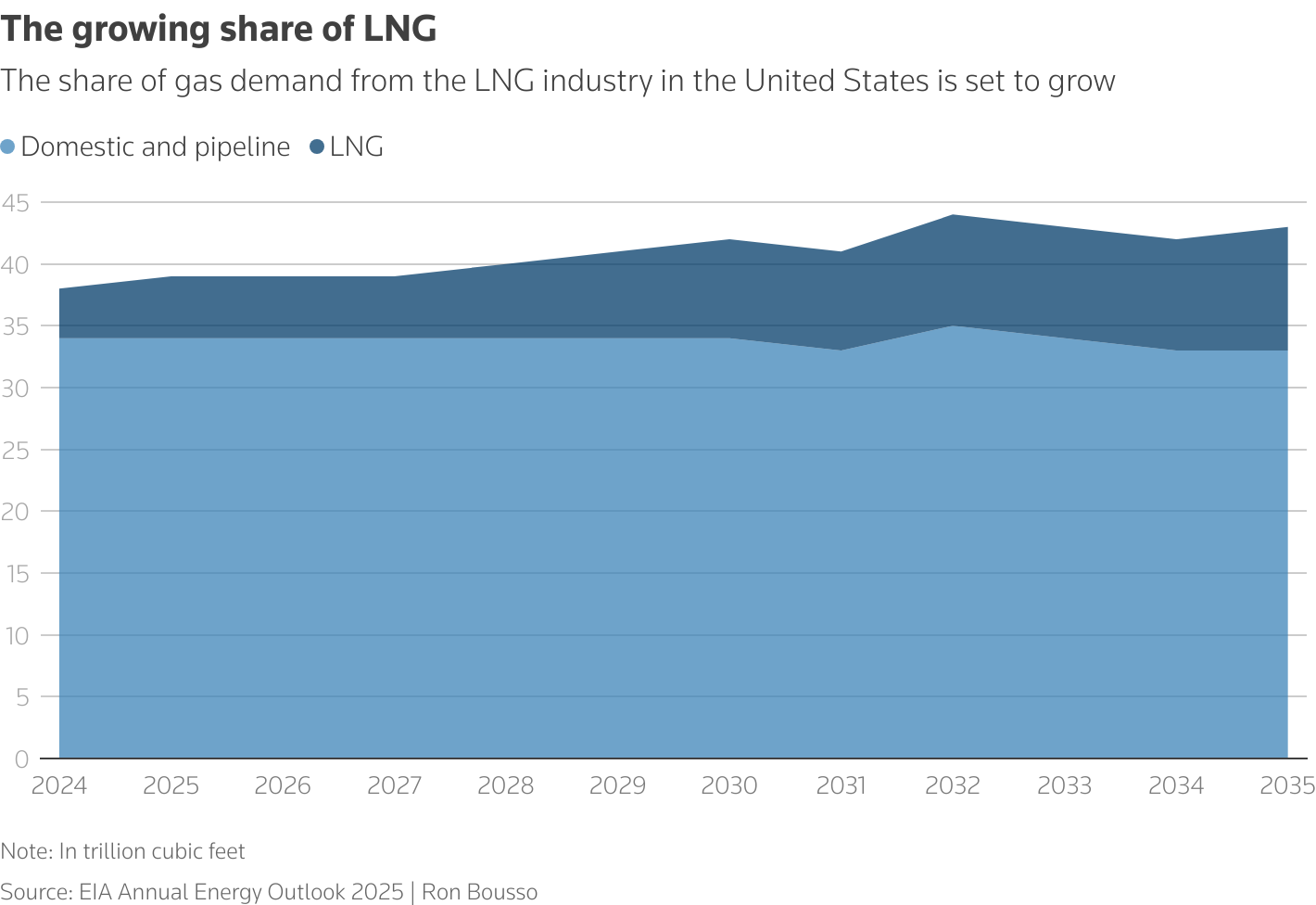

Increasing political risk. U.S. gas production is set to increase from around 39 tft3 in 2025 to 42 Tft3 in 2030, according to the Energy Information Administration. However, over the same period, the share of gas demand from LNG producers is set to rise from around 13% to 20%.

That is a recipe for a tighter domestic U.S. gas market.

Indeed, the combination of higher gas demand for LNG exports and increased domestic consumption due to energy-hungry data centers should put sustained upward pressure on U.S. prices in the coming years, particularly during winter.

That could be exacerbated by the reduction in renewables generation expected following the Trump administration’s row-back of clean-energy support.

This market dynamic may eventually become a political liability, however, as President Donald Trump has vowed to lower energy prices for U.S. consumers.

That pledge – and Trump’s goal of exporting more LNG – could be further complicated if U.S. producers see profit margins erode further and begin to trim operations.

As things currently stand, it seems only a matter of time until that is the case.

Related News

Related News

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- Mitsubishi Heavy Industries Compressor acquires Swiss rotating equipment maintenance company AST Turbo AG

- KBR awarded FEED for Coastal Bend LNG project

Comments