Opinion: High and rising natural gas costs may spur fresh climb in U.S. coal use

Benchmark U.S. natural gas prices are ending 2025 in the manner that they began - with a strong rally. And that's bad news for people hoping for further cuts to U.S. coal use.

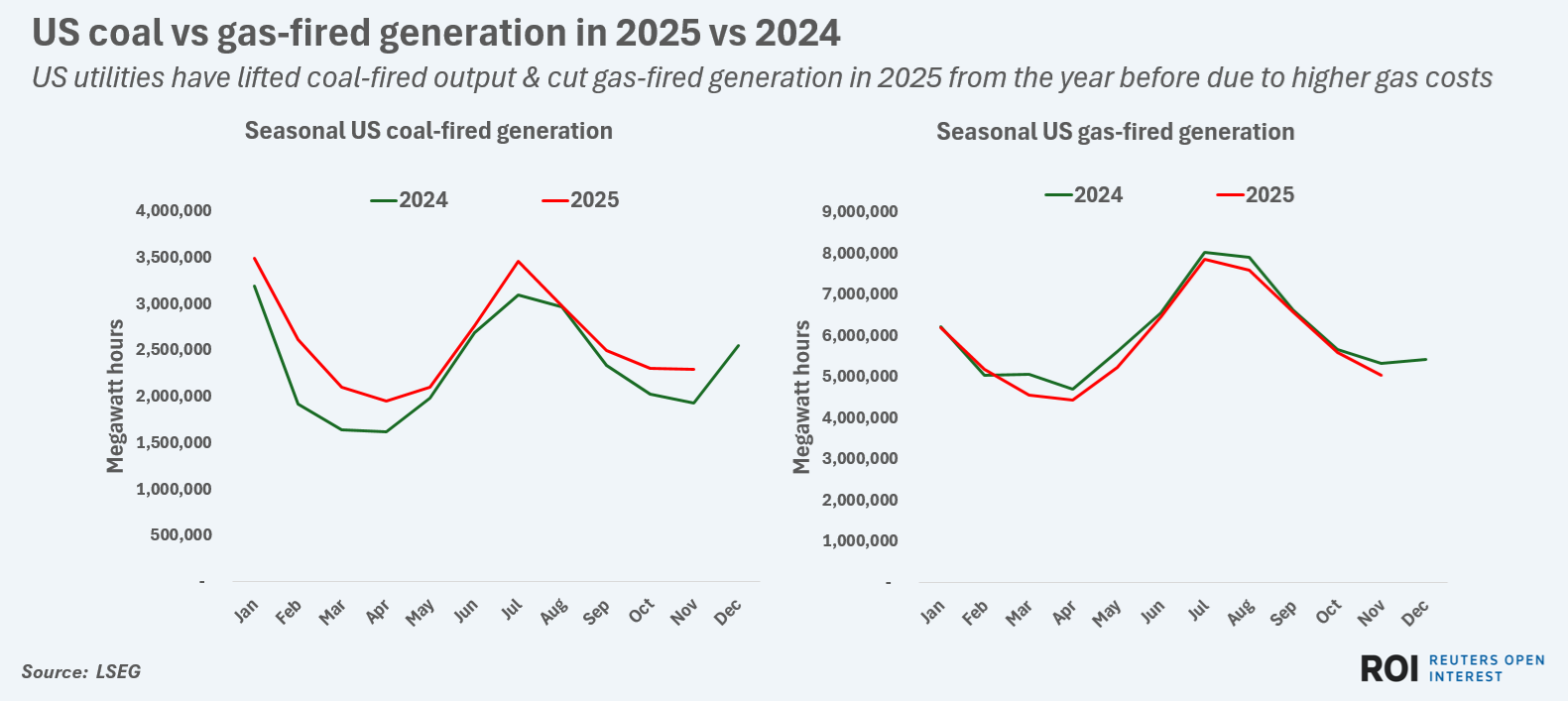

Between January and March of this year, U.S. gas prices jumped by a third due to a cold snap and strong LNG exports, which in turn sparked higher U.S. coal-fired power generation as utilities cut costs by burning cheaper coal instead of gas.

A similar pattern seems to be unfolding as 2025 winds down, with coal-fired generation on the rise and gas-fired output getting pared back as gas prices approach three-year highs and strain the budgets of power suppliers.

Once again, cold temperatures and record exports of liquefied natural gas (LNG) are major drivers of the gas-to-coal switching, although increased backing of the coal sector in Washington, D.C. is also underpinning coal consumption.

As coal-fired generation emits around 75% more carbon dioxide (CO2) per kilowatt hour (kWh) of electricity than gas-fired generation, per data from Ember, U.S. power sector emissions are bound to climb with rising coal output.

But with utilities under pressure to keep costs in check for consumers while ensuring power supplies meet demand needs, many utilities will view higher emissions as a necessary part of ensuring reliable and affordable power supplies this winter.

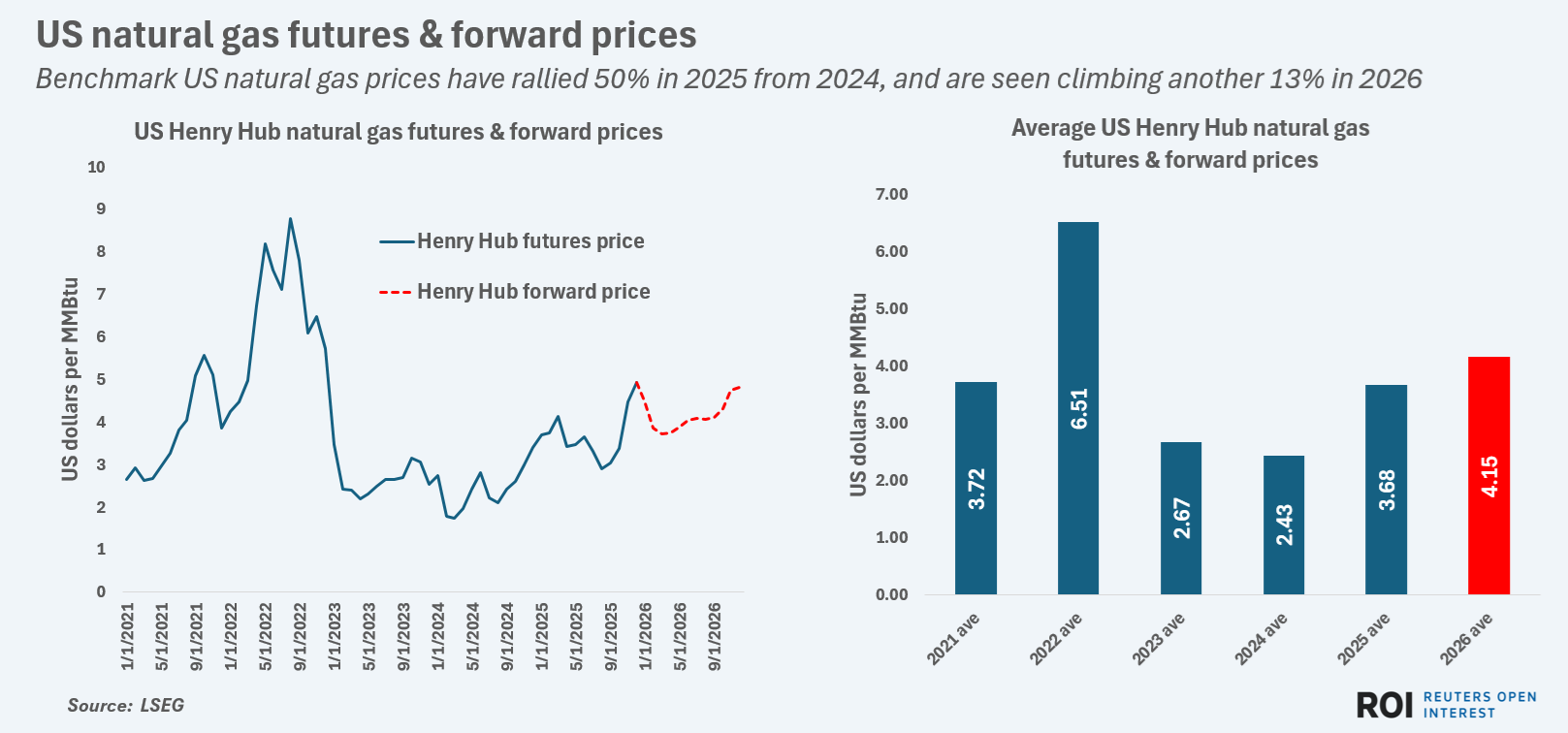

Price pain. Since the end of September, benchmark U.S. Henry Hub natural gas futures have climbed by more than 40% on a combination of rising gas use for heating and sustained strength in exports of LNG, which have climbed to a fresh record so far this year.

That price run-up exceeds the rally seen at the start of 2025, when futures prices climbed from around $3.50 per million British thermal units (MMBtu) to around $4.50/MMBtu by early March, LSEG data shows.

So far this week prices have surpassed $4.90/MMBtu and are targeting a breach of the $5.00 level for the first time since late 2022.

For now, futures markets are not pricing in a decisive push beyond the $5 mark this winter, with prices through to the end of March expected to average around $4.24/MMBtu, according to LSEG data.

However, for the whole of 2026 Henry Hub futures are currently expected to average $4.15/MMBtu, which would be the highest average annual U.S. natural gas price since 2022 and would mark the third straight year of U.S. gas price increases.

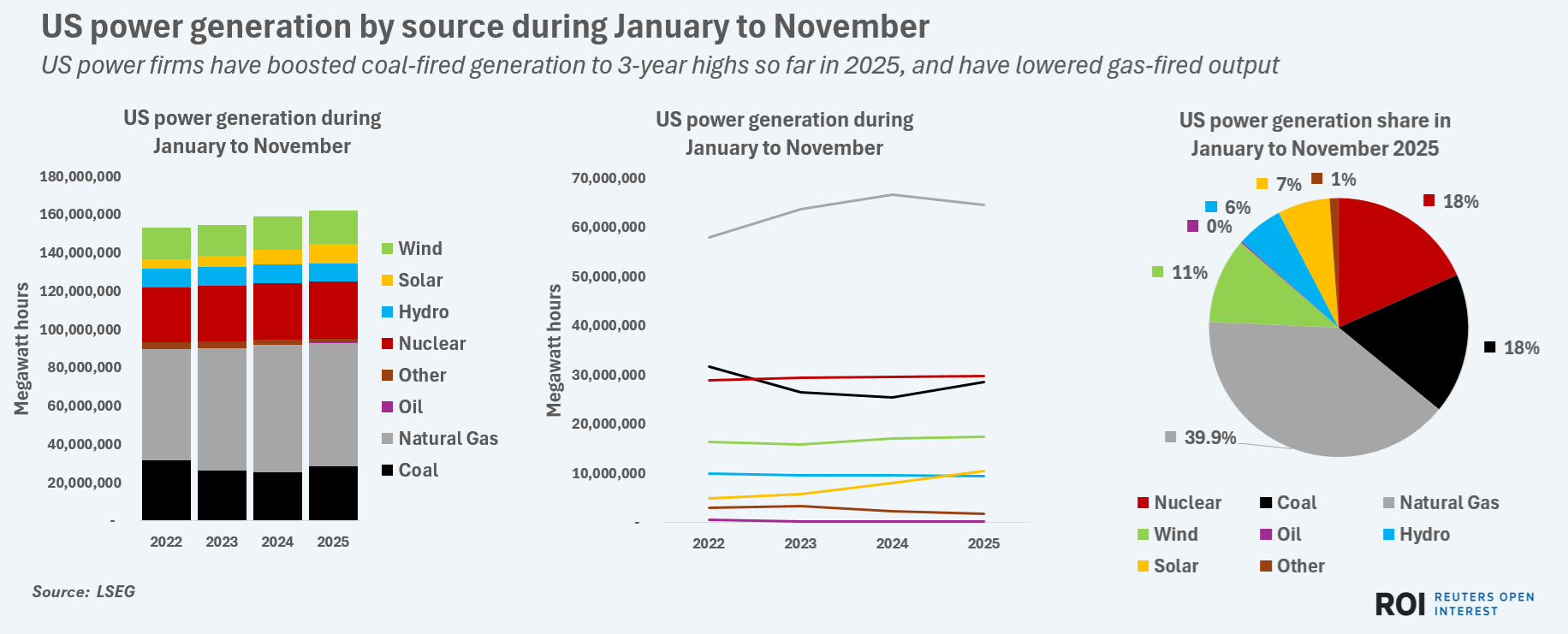

Coal crutch. The prospect of an additional 10% or more rise in benchmark natural gas costs will not be cheered by the U.S. power sector, which continues to rely on natural gas for around 42% of electricity supplies, according to Ember.

To avoid paying up for gas, several U.S. utilities are likely to opt to boost output from coal-fired power plants instead, and may try to curb gas-fired generation to cut costs.

Utilities followed a similar playbook during the first quarter of 2025, when U.S. coal-fired output increased by 21% from the same period in 2024 while gas-fired power output dropped by around 3% from the year before, LSEG data shows.

That trend of rising coal and lower gas generation has been evident again since September, with coal output during October and November up by around 16% compared to the same months last year and to the highest levels for those months since 2022.

Meanwhile, gas-fired power output during October and November was 3% down from the year before, and output in November was the lowest for that month in three years.

Coal-fired output levels are likely to climb further in December, as the first major cold snap of the 2025–2026 winter is only just about to strike just as gas prices approach fresh multi-year highs.

For utilities with both coal and gas-fired power plants at their disposal, the expansion of coal-fired output will make greater economic sense than cranking up gas use given the high gas costs.

LNG vs. power sector tensions. Increasing competition for gas with LNG exporters is another source of concern for utilities.

Brisk sales of U.S. LNG to global buyers have been a central tenet of the Trump administration's energy agenda, and have been broadly welcomed by the U.S. energy sector.

Power generators, however, have been less enthused about surging LNG export volumes, given that greater LNG exports can mean lower gas supplies for power plants.

Over the first 11 months of 2025, the U.S. has exported roughly 750 MM metric tons of LNG, according to Kpler, which is the highest tonnage on record for that period.

Additional gains in LNG export sales are likely over the final weeks of the year as major buyers in Europe and Asia stock up ahead of the coming winter.

If that higher sales pace coincides with an extended stretch of heating demand at home, gas prices will likely remain solidly underpinned and prone to bouts of strength.

That jittery price environment may only further encourage cuts to gas generation and greater reliance on coal for power, even if power emissions keep climbing as a result.

The opinions expressed here are those of Gavin Maguire, a columnist for Reuters.

Related News

Related News

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments