Taiwan bucks Asia's clean power drive with record gas burn

Taiwan's utilities have cranked natural gas-fired electricity generation to new highs this year, bucking regional and global trends toward increased clean energy within power mixes.

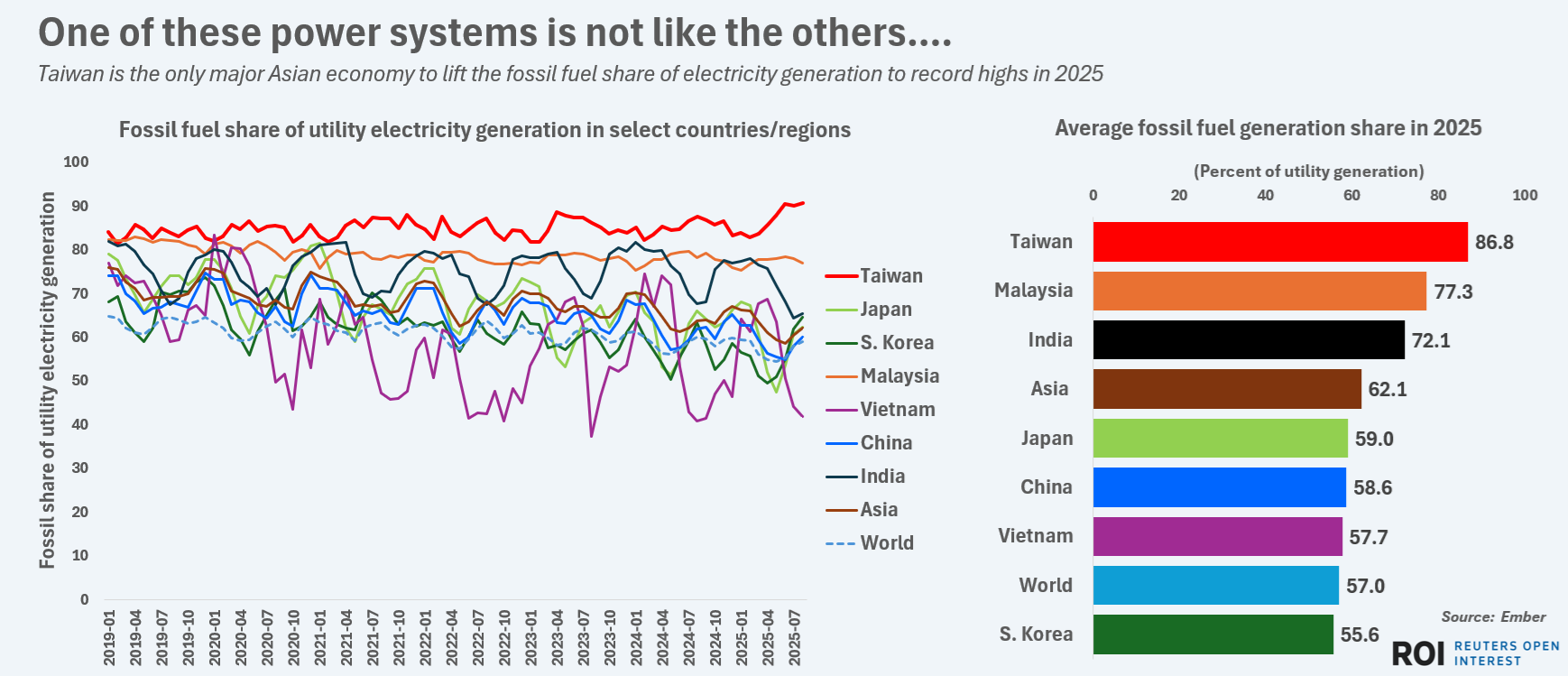

Just over 87% of Taiwan's electricity supply was produced by fossil fuels in the first eight months of this year, data from energy think tank Ember showed, the highest fossil fuel share on record for Asia's eighth-largest economy.

That fossil fuel generation share also sharply exceeded Asia's average of around 62% and the global average of 57%, meaning Taiwan stands out among major economies in terms of energy transition momentum - albeit for the lack thereof.

Taiwan’s terrain ill-suited for renewable farms. A dearth of raw material deposits means Taiwan must import more than 90% of energy products, including nearly all of the oil, coal and natural gas it burns.

The mountainous and densely populated island is also ill-suited to large-scale renewable energy farms, though there is rapidly growing adoption of rooftop solar systems in several areas.

The share of utility-scale electricity generation from renewable energy was around 11% last year. That could climb to around 15% in 2025 due to offshore wind projects that entered operation this year.

Taiwan did generate as much as 25% of electricity from nuclear reactors in the early 2000s but closed its last nuclear power plant in May due to political pressure and widespread public concern about safety.

The shutting of the Maanshan nuclear plant, alongside the still-limited generation footprint from renewable sources, means utilities remain heavily dependent on fossil fuel for the majority of power generation.

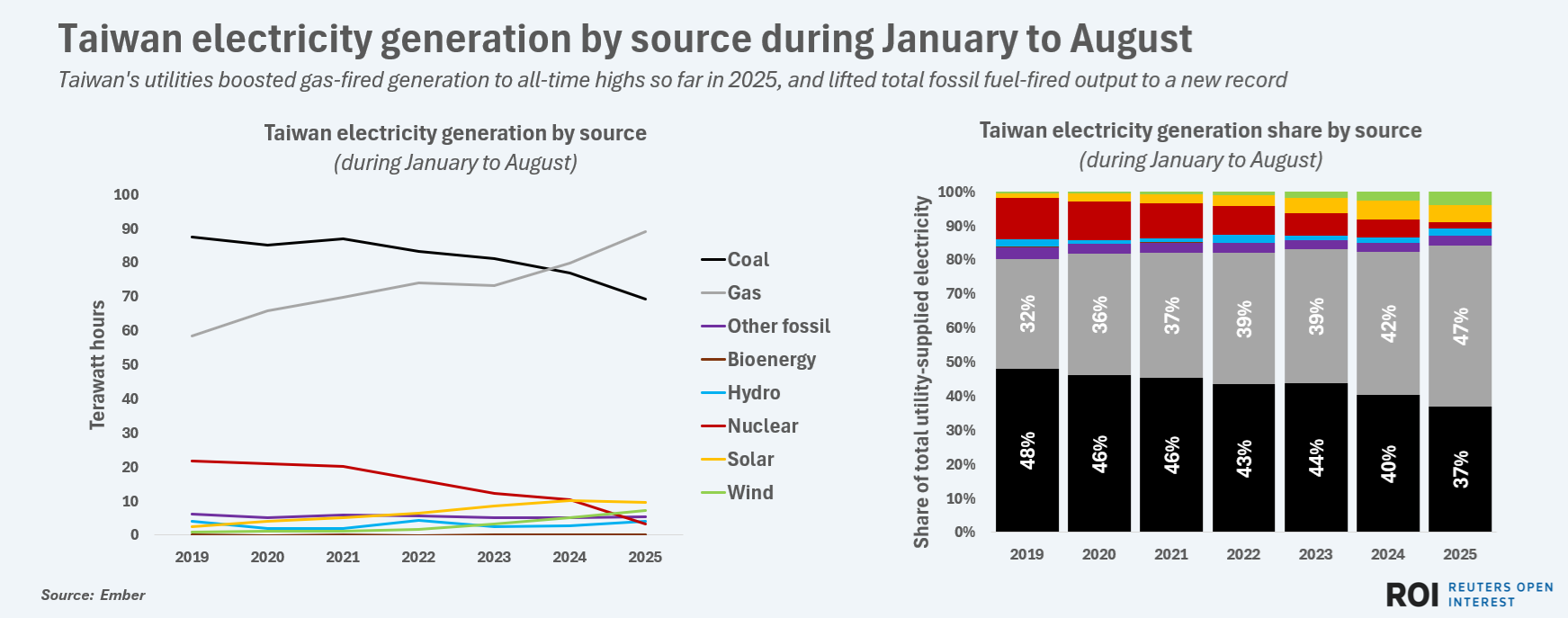

Utilities boost gas-fired generation to offset coal decline. While overall fossil fuel electricity generation scaled new highs this year, output from coal-fired power plants has steadily fallen since 2019 and so far this year has dropped to the lowest in at least a decade.

Public pressure to improve air quality has spurred the closure of outdated plants. So far this year, coal-fired generation has supplied less than 40% of electricity for the first time.

To offset reduced coal-fired output, as well as the shuttering of nuclear generation capacity, utilities have steadily increased natural gas-fired generation over the past five years or so.

During January to August, electricity output from gas-fired plants was 89.2 terawatt hours, Ember data showed. That marked a 12% increase from the same period a year earlier and a 52% jump from 2019. Gas-fired plants have generated a record 47% share of electricity so far this year.

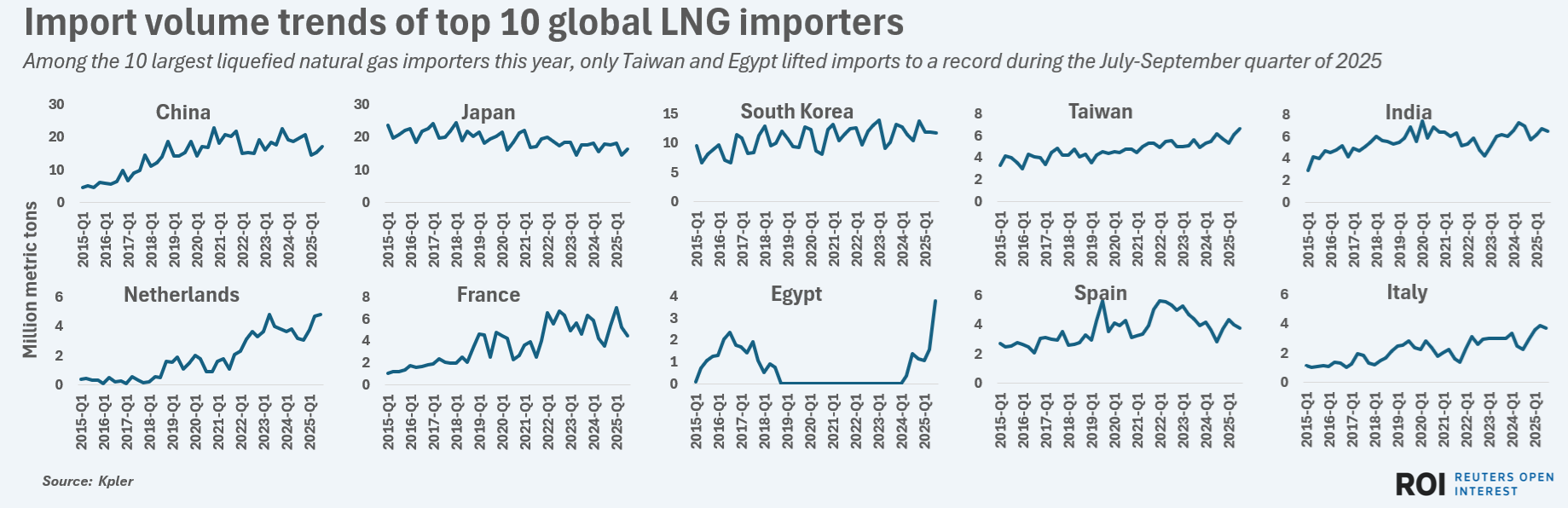

Taiwan’s imports of LNG have soared the most among peers. To fuel ever-increasing gas generation needs, Taiwan boosted imports of liquefied natural gas by 35% over 2019 through 2024, the largest percentage increase among the five biggest LNG importers over that period.

Over the first three quarters of this year, LNG imports have climbed to a record of 18 MM tonnes (t), showed data from commodities intelligence firm Kpler. That total marked a 7% rise from the same period a year prior, sharply outpacing China and Japan, which are the top two LNG importers but have registered contraction in import volume so far this year.

Taiwan's LNG imports during the three months through August set a record of 6.6 MMt, representing a bright spot in LNG import markets as nearly all other major importers reduced imports during that period.

As July and August typically mark high points for gas-fired power demand in Taiwan - due to higher use of energy-intensive cooling systems during the summer - LNG imports may slow in the coming weeks.

But given a high reliance on gas for power during the winter heating season, Taiwan looks set to remain a regular large LNG buyer for the foreseeable future.

That constant need for fossil fuel - both for imports and as the basis for its domestic power network - makes Taiwan stand out among peers as a holdout against the energy transition progress that is more evident elsewhere.

Continued build-out of wind farms should nudge renewable energy supplies steadily higher in due course. However, over the coming years at least, Taiwan will remain heavily fossil fuel-dependent and a stand-out customer for gas exporters.

The opinions expressed here are those of Gavin Maguire, a columnist for Reuters.

Related News

Related News

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

- Norway pipeline gas export down 2.3% in 2025, seen steady this year

Comments