EU energy policy trapped between U.S. gas and Chinese green tech

- EU reliance on U.S. LNG has grown since Russian gas phase-out

- China dominates EU's renewable energy supply chain

- EU trade deal with U.S. sets unrealistic energy purchase target

The European Union's lavish pledge to buy $750 B of U.S. energy by 2028 risks exacerbating the bloc's already outsized dependence on American gas, just as it finds itself increasingly reliant on Chinese technology to power its energy transition.

The EU has committed to boost purchases of U.S. oil, natural gas and coal from around $75 B in 2024 to $250 B per year over the next three years under the new trade deal with Washington.

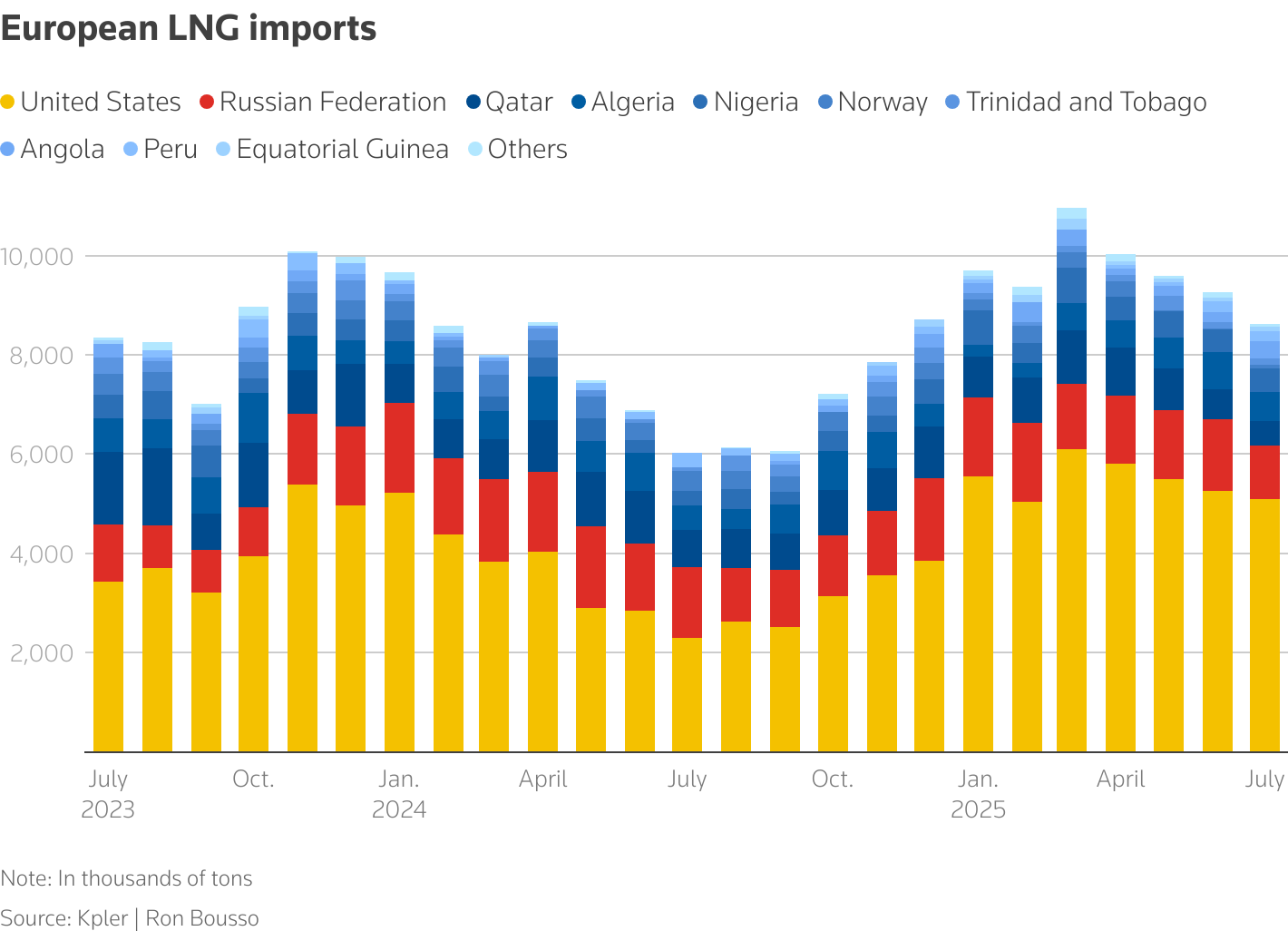

The U.S. already accounted for 50% of the EU’s liquefied natural gas (LNG) imports in 2024, as well as 17% of oil imports and 35% of coal imports, according to Eurostat data.

Any expansion in energy trade between the two regions would likely focus on LNG, as the U.S. is the world's top exporter of the super-chilled fuel.

However, the promised purchases appear not only unlikely but downright unrealistic, both because of the enormous volumes involved and the fact that EU energy trade is primarily determined by market forces, not centralized buying.

But the larger concern is that any increased purchases would accelerate Europe’s growing dependency on U.S. energy at a precarious moment.

Risky dependence. Europe has become heavily reliant on LNG imports due to its sharp reduction of Russian pipeline gas purchases following Moscow's invasion of Ukraine in 2022. Prior to that, Russia accounted for more than 40% of European gas imports.

Brussels plans to completely phase out Russian energy imports by 2027, a complex but feasible ambition that will further increase its need for LNG, which will come in large part from the U.S.

Relying on a democratic Western ally should create less political danger than tying oneself to an authoritarian power, but it is not risk-free.

For one, the Trump administration has engaged in erratic policymaking and bullying behavior that may make European leaders question the durability of any U.S. deal.

Additionally, the vast majority of LNG production is concentrated along the U.S. Gulf Coast, which faces the risk of extreme weather events such as hurricanes, floods and heatwaves. Such disasters could lead to abrupt and severe supply disruptions.

Furthermore, U.S. natural gas prices could rise sharply in the coming years as domestic demand rises, particularly given the astronomical power needs of artificial intelligence.

Indeed, the U.S. Energy Information Administration forecasts Henry Hub gas prices will double between 2024 and 2026 to $4.40 per million British thermal units. Such price spikes could render American LNG less competitive versus other supplies.

Chinese wall. The energy crisis that followed Moscow's invasion of Ukraine taught Europe two painful lessons: don’t be heavily reliant on any single energy supplier, and true energy security means reducing reliance on fossil fuels, especially given the EU’s insufficient and dwindling domestic production.

To address the latter concern, the bloc has accelerated investments in renewables, nuclear and battery storage technologies.

European investment in clean energy is set to reach $494 B in 2025, doubling from a decade ago, according to a recent report by the International Energy Agency. Renewables such as solar and wind generated half of the region's electricity and around 20% of total energy consumption last year.

The rapid growth in renewables comes with its own dependency risks, however, as the green energy supply chain is dominated by Chinese technology.

Solar power is the fastest source of Europe’s renewable energy growth, and China supplies around 80% of the EU's solar photovoltaic panels. And it does so at an extremely low cost, which has for years impeded Europe’s efforts to expand domestic manufacturing in this area.

While Europe has a strong local wind turbine industry, which accounts for about 80% of its supply chain, and a robust battery manufacturing industry, China dominates the processing of critical raw materials, such as lithium, cobalt and nickel, essential for storage batteries as well as the production of rare earth magnets used in wind turbines.

No good choices. Diversifying the EU’s sources of renewables technologies and critical minerals is therefore crucial for the bloc’s energy security, though this will take years to achieve.

In theory, cooperating with the U.S. on this front could prove beneficial, but not if Washington uses its dominant position to squeeze more concessions from the EU while offering little in return.

The EU, the world's second largest economic zone, therefore finds itself caught between two geopolitical powers.

And the bloc’s twin concerns – increasing dependence on U.S. LNG, and overreliance on China for its renewables supply chain – may ultimately cause European leaders, worried about high energy costs, to lean back into fossil fuels.

Balancing energy security and political realities will determine the pace and success of the EU's energy policies in the coming years. But if the terms of the recent U.S. trade deal are any indication, the EU is not off to a very good start.

Related News

Related News

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- Mitsubishi Heavy Industries Compressor acquires Swiss rotating equipment maintenance company AST Turbo AG

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- KBR awarded FEED for Coastal Bend LNG project

Comments