The U.S. remained the largest liquefied natural gas supplier to Europe in 2023

Data source: CEDIGAZ and the International Group of Liquefied Natural Gas Importers (GIIGNL)

Note: Other includes Angola, Argentina, Australia, Cameroon, Egypt, Equatorial Guinea, Indonesia, Libya, Mozambique, Norway, Oman, Papua New Guinea, Peru, Trinidad and Tobago, United Arab Emirates, and Yemen. LNG=liquefied natural gas

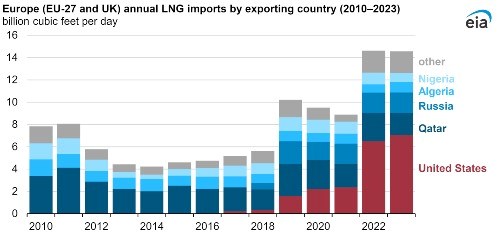

The United States was again the largest supplier of liquefied natural gas (LNG) to Europe (EU-27 and the UK) in 2023, accounting for nearly half of total LNG imports, according to data from CEDIGAZ. Last year marks the third consecutive year in which the United States supplied more LNG to Europe than any other country: 27%, or 2.4 billion cubic feet per day (Bcf/d), of total European LNG imports in 2021; 44% (6.5 Bcf/d) in 2022; and 48% (7.1 Bcf/d) in 2023.

Qatar and Russia remained the second- and third-largest LNG suppliers to Europe last year. Qatar supplied 14% (2.0 Bcf/d), and Russia supplied 13% (1.8 Bcf/d). Combined, the United States, Qatar, and Russia supplied three-quarters of Europe’s LNG imports in 2022 and 2023.

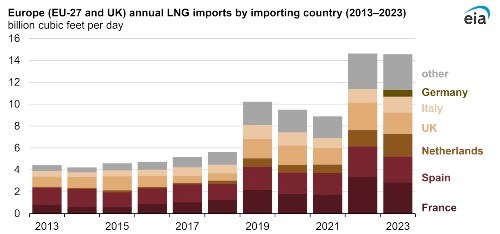

Europe’s LNG import, or regasification, capacity is on track to expand to 29.3 Bcf/d in 2024, an increase of more than one-third compared with 2021, according to data from the International Group of Liquefied Natural Gas Importers (GIIGNL) and trade press. Russia's full-scale invasion of Ukraine in February 2022 prompted European countries to halt most imports of natural gas from Russia via pipeline and reactivate development of previously dormant regasification projects as well as develop new projects. Germany is adding the most LNG regasification capacity in Europe: developers added 1.8 Bcf/d in 2023 and plan to add 1.6 Bcf/d in 2024. In 2022 and 2023, the Netherlands, Spain, Italy, Finland, and France increased their regasification capacity by a combined 3.2 Bcf/d. In 2024, we expect Belgium, Greece, Poland, the Netherlands, and Cyprus to add a combined 1.8 Bcf/d of new capacity.

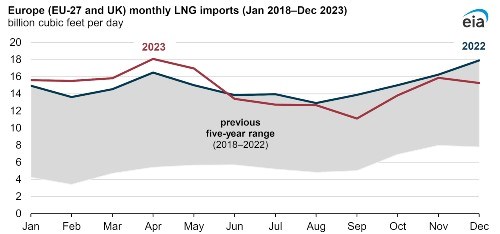

In 2023, Europe’s LNG imports averaged 14.7 Bcf/d, essentially unchanged from 2022, despite an estimated 4.2 Bcf/d of regasification capacity additions. Mild 2022–23 winter weather in the Northern Hemisphere reduced heating demand and contributed to Europe ending the winter heating season with record-high natural gas in storage. LNG imports into Europe established new records from June 2022 through April 2023, when imports peaked at 18.1 Bcf/d. Imports then declined in subsequent months because storage inventories were full, international LNG prices were relatively high, and energy conservation measures significantly reduced natural gas consumption.

Data source: CEDIGAZ

Note: LNG=liquefied natural gas

In 2023, France, Spain, the Netherlands, and the UK combined accounted for almost two-thirds (9.3 Bcf/d) of Europe’s total LNG imports. Germany imported its first LNG in January 2023 and ended the year accounting for 4% (0.6 Bcf/d) of Europe’s total imports. The United States supplied more than 80% of Germany’s LNG imports.

Data source: CEDIGAZ

Note: Other includes Belgium, Croatia, Finland, Greece, Lithuania, Malta, Poland, Portugal, and Sweden. LNG=liquefied natural gas

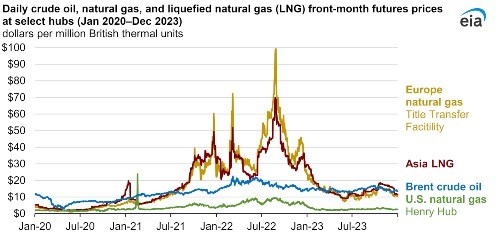

Natural gas prices at the Title Transfer Facility (TTF) in the Netherlands—a large natural gas trading hub in Europe—started to increase in the second half of 2021, and by 2022, averaged $40.30 per million British thermal units (MMBtu) annually. TTF prices reached nearly $100.00/MMBtu in August 2022, significantly higher than the 2019–20 average of $3.86/MMBtu amid concerns over natural gas supplies for the winter given the uncertainty over the future of piped natural gas from Russia. In January 2023, however, TTF prices began to decline from a monthly average of $20.43/MMBtu to $10.06/MMBtu by May as natural gas balances in Europe continued to improve. From June 2023 through the end of the year, TTF prices averaged $11.89/MMBtu, falling below LNG prices in East Asia.

Data source: Bloomberg Finance, L.P.

Related News

Related News

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- Trinity Gas Storage reaches FID on Phase II expansion

Comments