Spain becomes Europe's cheapest gas market on flood of low-cost LNG

The Spanish gas market has become the cheapest in Europe for the first time, distorted by an influx of low-priced liquefied natural gas (LNG) cargoes that keep arriving in the country despite subdued demand.

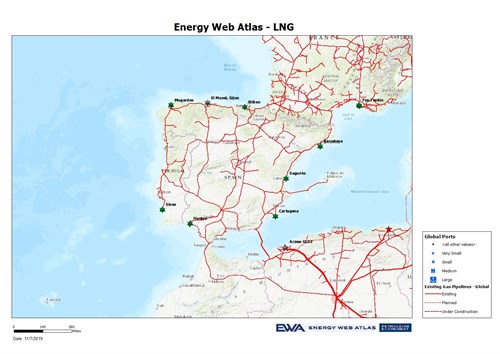

Gas prices in Spain - Europe’s major LNG market - usually hold a premium over prices on some major European gas markets because the country imports gas from fewer supply sources.

But in the past week Spanish gas prices for day-ahead, weekend and December delivery dropped to the lowest level across the continent as once expensive LNG has been trading lower than gas on some European gas hubs this year, flooding markets including Spain.

“Plenty of LNG is coming to Spain but (it) looks like no one wants to buy gas (on the domestic market). It’s terrible,” an industry source in Spain said.

The day-ahead contract on Spanish gas hub PVB was around 1.3 euros below Europe’s benchmark Dutch gas price on Thursday, a gas trader said. Spanish December delivery gas was around 0.37 euro cheaper, while the weekend contract was more than 2 euros cheaper, according to another source.

Spain has imported 14.24 million tonnes of LNG this year so far, a 50% increase from the same period in 2018, Refinitiv data shows.

Spot LNG arriving to the country now was purchased at least one or two months ago. “Price gave incentive to importers to do so (at that time). The problem is that if demand is not strong, the system is unable to cope, so the price collapses,” one gas trader said.

Traders pointed out that power prices are low in Spain and said that strong wind is decreasing demand for gas in power generation now.

Gas storage in Spain is almost 95% full, a situation similar to most European gas markets.

LNG stocks have also been high, with importers holding off on processing the liquid earlier this year, awaiting higher prices and creating a block in the supply chain.

As more cargoes arrive in the country now, LNG has to be re-gasified and sent to the gas system to give room for new arrivals, which is leading to an oversupply on the Spanish market.

Looking forward, traders forecast a more balanced situation in the first quarter of 2020 as the LNG influx may reduce slightly, while demand is likely to rise.

“Having (Spanish gas hub) PVB at a great discount to Dutch or French (gas) will impact future imports of LNG in Spain,” one trader.

“Importers will have to price this possibility as a risk, therefore potential future bids will be lower and probably that will impact on how competitive the Spanish importers can be.” (Reporting by Ekaterina Kravtsova; Editing by Susan Fenton)

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- Trinity Gas Storage reaches FID on Phase II expansion

Comments