EIA: Pipeline explosion in Canada leads to lower US natural gas imports, higher regional prices

A natural gas pipeline rupture on October 9, 2018, in British Columbia has resulted in a sharp decline in U.S. natural gas imports from Canada, causing higher prices in the Pacific Northwest and logistical challenges for the pipeline network in the region.

U.S. imports of natural gas at Sumas, Washington, have averaged about 460 million cubic feet per day (MMcf/d) since October 18, according to data from Genscape. A week before the incident, U.S. imports at that location averaged about 930 MMcf/d. Spot natural gas prices at the Northwest Sumas (at the British Columbia-Washington border) trading hub, which were trading at a discount to Henry Hub before October 9, reached $7.79/MMBtu on Monday, October 22, $4.58/million British thermal units (MMBtu) higher than Henry Hub. Prices have since declined, closing yesterday (Wednesday, October 24) at $5.20/MMBtu, $1.85/MMBtu higher than the Henry Hub, according to Natural Gas Intelligence.

Enbridge’s Westcoast pipeline in Canada consists of two parallel lines (a 36-inch pipeline and a 30-inch pipeline) that can transport up to 1.7 billion cubic feet per day (Bcf/d) during winter months. Following the explosion on the 36-inch pipeline, flows from Canada into Sumas fell to zero as the adjacent 30-inch line was shut down and inspected.

Pipeline operations resumed on October 11, and U.S. imports from Canada averaged 300 MMcf/d until higher pressures in the pipeline were approved on October 18, allowing imports to increase to their current levels. Enbridge announced that it expects repairs on the 36-inch line to be completed by mid-November and that the Westcoast pipeline system will operate at a reduced capacity of 0.9 to 1.3 Bcf/d throughout the winter.

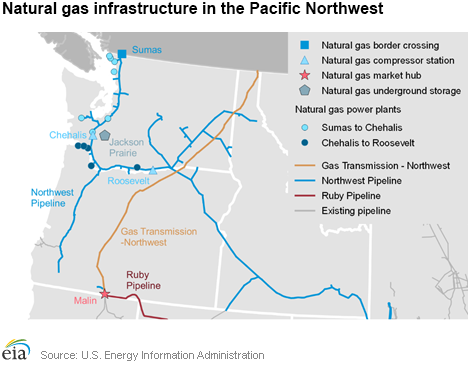

Shifts in regional natural gas flows along the interstate natural gas pipeline system in the U.S. Pacific Northwest have made up for the shortfall in natural gas imports from Canada at Sumas. For example, the Northwest Pipeline (NWPL), which had been delivering natural gas for injection into the Jackson Prairie storage field in western Washington, was instead transporting natural gas withdrawn from storage northward toward the Seattle-Tacoma market in the days after the incident, according to NWPL’s informational postings.

NWPL is also maximizing westward flows at the Roosevelt compressor station, which is centrally located on the Oregon-Washington border. On October 18, the company issued an Operational Flow Order and OFO Recall Advisory informing its shippers that the Roosevelt compressor station was operating at near-complete utilization (560 MMcf/d).

A similar shift has been observed on the 1.5 Bcf/d Ruby Pipeline (Ruby). On October 23, Ruby, which transports Rockies natural gas to western demand markets, flowed 1.25 Bcf/d of natural gas to the California-Oregon border at Malin―the highest flows reported on Ruby since November 2015.

Decreased deliveries of natural gas to power plants is another effect the limited natural gas supplies and higher prices have had on the region. Deliveries from NWPL to power plants west of the Roosevelt compressor station declined from 400 MMcf/d before the explosion to an average of 100 MMcf/d from October 10 to October 15, according to Genscape flow data. Since October 18, deliveries to these generators rose to 200 MMcf/d, but remain much lower than before the explosion. Power plants between the Sumas and Chehalis compressor stations in northwest Washington account for most of this difference because delivered volumes to power plants along that stretch of pipeline are only 25% of their pre-event levels.

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- Trinity Gas Storage reaches FID on Phase II expansion

Comments