Thailand reveals LNG import ambitions

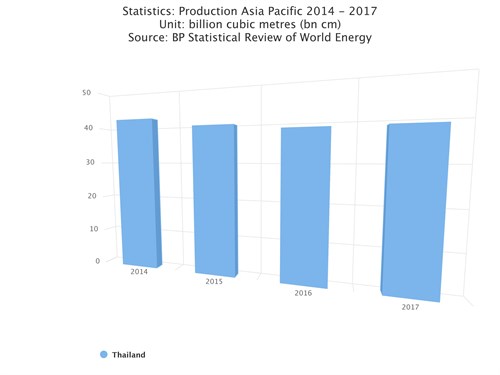

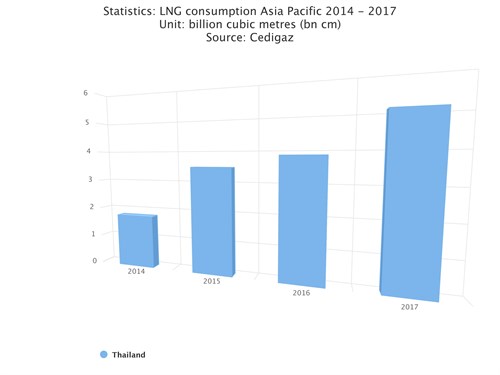

Interfax Energy - Thailand is set to import 36 mtpa of LNG by 2030, up from around 2.9 mtpa in 2016, as gas domestic production is set to decline rapidly after 2020, an official from the country’s Ministry of Energy said.

Domestic output currently provides more than 70% of Thailand’s gas while pipeline deliveries from Myanmar account for most of the rest, Porrasak Ngamsompark, acting director of the LNG management bureau at Thailand’s Department of Mineral Fuels, said at the event, part of Singapore International Energy Week.

|

| Map Source: EWA |

LNG has played a relatively small role in Thailand’s energy mix to date, but this situation is set to change by 2030, when LNG is expected to make up the bulk of the country’s gas supply, Ngamsompark added.

The government is looking to secure additional long-term LNG import contracts to ensure it will be able to meet future demand.

|

| Map Source: EWA |

“Effective and efficient LNG sourcing will need long-term contracts that will form part of our supply portfolio,” Ngamsompark told delegates.

Thailand currently has long-term contracts with Qatar, Shell, BP and Petronas for a combined 5.2 mtpa of LNG. Petronas started delivering cargoes under its contract only in July this year, while Shell started delivering cargoes under its contract in 2016. This means full-year imports for 2017 will be significantly higher.

PTT, Thailand’s state-owned oil and gas company, recently signed an agreement with the Anadarko-led Mozambique LNG project for a further 2.6 mtpa – its largest import deal to date. PTT is a stakeholder in Offshore Area 1, where the feed gas for the project will be produced.

“The long-term contract [with Mozambique] will help diversify our LNG procurement,” Ngamsompark told delegates.

Existing infrastructure

Thailand currently has a single LNG terminal, at Map Ta Phut. Work to expand the terminal’s capacity from 5 mtpa to 10 mtpa was completed earlier this year, and there are plans to expand capacity by a further 1.5 mtpa by 2019. Bangkok hopes to increase Map Ta Phut’s capacity to 20 mpta over the next 10 years.

The government has approved a second LNG terminal, which will be built in Rayong province and is expected online early next decade. It will have an initial capacity of 5 mtpa and could be expanded to 7.5 mtpa in a second phase of development.

Slides presented by Ngamsompark showed plans for two FSRUs in Thailand. The first project, which will have a capacity of 5 mtpa, will come online in 2024; the second, which will have a capacity of 2 mtpa, will come online in 2028.

Thailand is Southeast Asia’s biggest importer of LNG and intends to use its large investment in regasification infrastructure to become a trading centre for the region.

“We plan to import LNG into the rest of [the Association of Southeast Asian Nations: ASEAN] from Thailand and build the infrastructure to become an LNG hub,” Ngamsompark told delegates.

Thailand plans to have excess LNG import capacity that it will make available via third-party access in a bid to develop the country as a hub, Ngamsompark added.

“We are expanding gas infrastructure in Thailand that everyone can use and we will be implementing third-party access [to the LNG terminal] at the end of next year,” he said.

This means Thailand is expected to need spare LNG import capacity that can be made available for companies looking to deliver cargoes to other countries in the ASEAN region.

Around 70% of Thailand’s power is gas-fired, and the country is expected to rely heavily on gas for its energy needs over the coming years. Ngamsompark said the Ministry of Energy’s gas plan has been directly influenced by projections for the country’s power needs based on GDP, population growth and political considerations over the next 13 years.

Article originally published on Gastech Insights

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- Trinity Gas Storage reaches FID on Phase II expansion

Comments