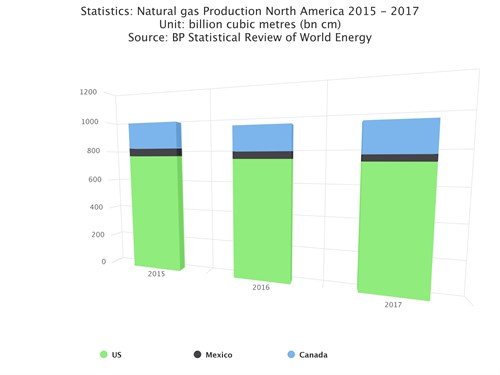

Appalachia, Permian, Haynesville drive U.S. natural gas production growth

Gross production of natural gas in the United States has generally been increasing for more than a decade and in recent months has been more than 10% higher compared with the same months in 2017. This growth has been driven by production in the Appalachian Basin in the Northeast, the Permian Basin in western Texas and New Mexico, and the Haynesville Shale in Texas and Louisiana. These three regions collectively accounted for less than 15% of total U.S. natural gas production as recently as in 2007, but now they account for nearly 50% of total production.

|

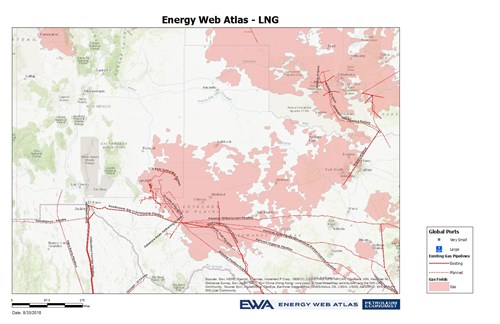

| Source: EWA |

Production in these regions has increased in part because of new drilling and completion techniques, including longer well laterals that have increased well productivity. By contrast, the Gulf of Mexico's share of total production, which was 12% in 2007, has fallen to just 3% in recent months, and the share of production in the rest of the United States has declined from 60% to 28%.

Growth in natural gas production in the Northeast has come mainly from the Marcellus and Utica shale plays in the Appalachian basin, which collectively accounted for about 29% of total production in July 2018. Recent infrastructure buildout in the region has allowed natural gas to move out of the region and has reduced the prevailing discount to the national benchmark price at Henry Hub and to regional prices.

Natural gas production in the Permian Basin has also grown in recent years, largely in the form of associated gas accompanying the region’s rising crude oil production. Similar to the Appalachian Basin, natural gas in the Permian trades at lower prices relative to Henry Hub because of regional infrastructure constraints. A number of new natural gas pipelines are planned or under construction that will help move natural gas out of the region, and several of them will expand liquefied natural gas export capability. EIA projects that July 2018 production in the Permian Basin will account for about 11% of total U.S. gross production.

|

| Map Source: EWA |

Production in the Haynesville region has also increased. After decreasing from its peak in 2012, increasing production in the Haynesville region since 2017 has been driven by improving initial production rates and increasing rig counts. Higher rig counts are likely a result of recovering crude oil prices, which have been generally increasing since early 2016. Together, the Haynesville and the Permian regions accounted for nearly 20% of total U.S. natural gas production in 2017.

In contrast to the Appalachian, Permian, and Haynesville regions, the Gulf of Mexico has accounted for an increasingly smaller portion of national production, which is a significant change from a decade ago. Older wells in the Gulf tend to be more natural gas-rich, and newer wells tend to be more oil-rich. These factors contributed to the overall decline in that region's natural gas production. In addition, the technology and expertise required to produce oil and natural gas from the seabed is more expensive and specialized. Drilling platforms sometimes cost a billion dollars or more and take several years to construct. Finally, offshore projects generally carry higher risk than onshore projects.

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- Trinity Gas Storage reaches FID on Phase II expansion

Comments