NextDecade Corporation on Rio Grande LNG: Providing a valuable link to global markets

The U.S continues to grow into one of the largest players in the global LNG market and it is showing no signs of slowing down. With more export projects being proposed and coming online, the shale gas discovery really has reshaped the industry as we know it.

NextDecade Corporation is an LNG development company intending to develop a portfolio of LNG projects, including the 27 mtpa Rio Grande LNG export project in Texas.

Interested to gain exclusive updates on the project and provide a taster of what’s to come at Gastech 2018 in Barcelona, Gastech Insights spoke with President & CEO of NextDecade Corporation and speaker at Gastech 2018, Matt Schatzman.

Gastech Insights: The Permian Basin is said to be at the heart of the US shale revolution. Do you see it continuing to play a larger role in gas supply over the next 5 years?

Matt Schatzman: Absolutely. Technical advancements have improved well productivity and total resource availability across the United States. One producing area, in particular, that has garnered significant attention and capital in the past 18-24 months is the Permian Basin. Currently, about half of all active U.S. rigs are in the Permian, up from just 20% in 2014. Permian Basin production economics are driven by oil. Furthermore, both Texas and New Mexico prohibit long-term flaring. We estimate the Permian Basin holds nearly 500 Tcf with break-evens below $0. Due to its proximity to the Permian Basin, as well as the Eagle Ford Shale, NextDecade’s Rio Grande LNG project will – for customers around the world – facilitate access to abundant, low-cost, reliable natural gas, and likewise provide U.S. producers with a valuable link to global markets.

Gastech Insights: In your opinion, where will the next wave of LNG production come from?

Matt Schatzman: If investment in new liquefaction capacity is not made in the very near future, we anticipate global LNG demand will exceed available supply by 150 mtpa by 2025. Approximately one-third of these requirements may be satisfied by projects outside of North America. We believe most of the remaining 100 mtpa of new liquefaction capacity will be developed on the U.S. Gulf Coast. The U.S. is rapidly emerging as an increasingly important player in the global LNG market. We anticipate that, by 2025, the U.S. could be the world’s largest supplier of LNG, producing approximately 32% of global volumes.

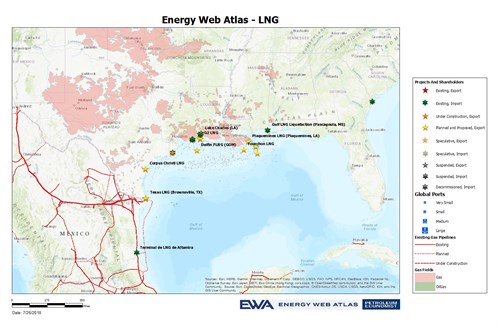

|

| Map Source: EWA |

Gastech Insights: Where is LNG demand coming from to support new projects and do you expect this to continue?

Matt Schatzman: We believe that the global LNG market is in the early stages of a prolonged period of structural demand growth. Asian markets – and China, in particular – represent large and growing demand centers, but demand growth is not limited to this region. We are seeing higher LNG demand in both developed and emerging markets on account of environmental policies, among other drivers. Major infrastructure investment has already changed the landscape dramatically. Today, more than three dozen countries import LNG, up from just 11 in 2000. In fact, the global market grew by nearly 19% in the three years ending December 2017.

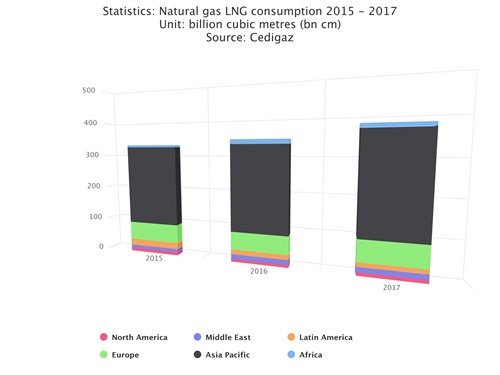

|

| Source: EWA |

Gastech Insights: Having completed the FEED package in February for Rio Grande LNG, can you share the latest updates on the project and what it will bring to the market?

Matt Schatzman: NextDecade continues to make strides with its Rio Grande LNG project as it moves through the U.S. regulatory process. For customers around the world, we are facilitating access to abundant, low-cost, reliable natural gas, and likewise providing U.S. producers – especially in the Permian Basin – a valuable link to global markets. Our management team has experience in developing, marketing, and operating LNG projects around the world. Using large-scale, proven technology, we expect to have extremely competitive EPC costs through every phase of development

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- Trinity Gas Storage reaches FID on Phase II expansion

Comments