China National Petroleum Corporation drives China gas production in 2021

Over $16.3bn in capital expenditure (capex) will be spent by China-focused operators on gas projects over the next four years, to ensure the country’s production will remain around 16.7 billion cubic feet per day (bcfd) in 2021, according to GlobalData, a leading data and analytics company.

|

China National Petroleum Corporation will drive China’s gas production with 63.5 percent share of all production in 2021. China Petrochemical Corp and China National Offshore Oil Corporation follow with 24.8 and 5.5 percent, respectively. China has three key upcoming gas projects; all three will be producing by 2021.

China National Offshore Oil Corporation will lead in Greenfield gas projects, with participation in three upcoming projects each in the near future. The rest of the participants have one upcoming project each.

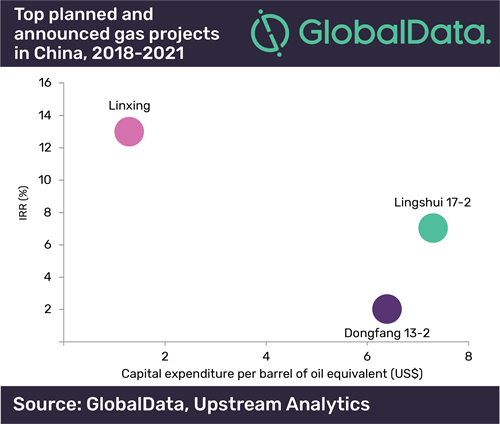

China is expected to spend $16.3bn as capex on conventional gas projects during 2018 to 2021, with spending topping $7.0bn in 2018. Average full cycle capex per barrel of oil equivalent (boe) for China gas projects is $10.8. Conventional gas projects have full-cycle capex of $10.4/boe, while unconventional gas projects and CBM projects need $13.6 and $9.1 per boe in full cycle capex respectively.

Shallow water projects have an average full cycle capex of $11.8 per barrel of oil equivalent, followed by onshore and deepwater projects with an average full cycle capex per boe of $10.9 and $8.5, respectively. New gas projects average $9.1 per barrel of oil equivalent in capex.

Average development break-even price for gas projects in China is about $7 per thousand cubic feet (mcf). Shallow water projects require a gas price of $8 per mcf to break even, while the onshore and deepwater projects have a development break-even price of $7 and $6 per mcf, respectively.

SOURCE: Global Data

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- Trinity Gas Storage reaches FID on Phase II expansion

Comments