EIA: China leads the growth in projected global natgas consumption

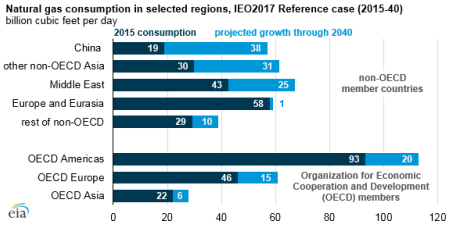

Global natural gas consumption is expected to grow from 340 Bcfd in 2015 to 485 Bcfd by 2040, primarily in countries in Asia and in the Middle East, based on projections in EIA’s latest International Energy Outlook 2017. China accounts for more than a quarter of all global natural gas consumption growth between 2015 and 2040.

|

| Courtesy of EIA. |

The projected growth in natural gas consumption in China is driven by environmental policies, relative cost competiveness of natural gas in the industrial and transportation sectors, and relatively high economic growth.

China’s environmental policies are designed to reduce air pollution and carbon emissions by promoting natural gas in the country’s energy mix—replacing some coal and oil use with natural gas. In China’s 13th Five-Year Plan and the latest Energy Production and Consumption Revolution Strategy (2016-30), the Chinese government set targets to increase the share of natural gas in the primary energy mix from 5.9% in 2015 to 10% by 2020 and 15% by 2030.

EIA projects China’s natural gas consumption to grow from 19 Bcfd in 2015 to 57 Bcfd in 2040, surpassing all other countries except the United States. In the IEO2017 Reference case, US natural gas consumption is projected to grow at a more modest rate, from 75 Bcfd in 2015 to 88 Bcfd in 2040, with the United States remaining the world’s largest natural gas consumer.

China’s domestic natural gas production reached 13 Bcfd in 2016, accounting for 64% of China’s total natural gas supply. The IEO2017 Reference Case projects that China’s domestic natural gas production will reach 39 Bcfd by 2040, driven primarily by the development of shale gas resources. EIA estimates that China holds the largest reserves of technically recoverable shale gas in the world, and China was among the first countries outside of North America to develop its shale resources.

The IEO2017 Reference case projects China’s shale gas production will grow from 0.7 Bcfd in 2016 to 10 Bcfd by 2030 and 19 Bcfd by 2040, when shale gas is projected to account for a third of China’s total natural gas supply. China’s natural gas production from other sources, such as coalbed methane, tight formations, and more traditional natural gas reservoirs, is projected to increase more modestly, from 12 Bcfd from these sources in 2016 to 20 Bcfd by 2040.

Pipeline natural gas and LNG imports make up the rest of China’s supply, collectively accounting for 36% of the 2016 total and projected to account for 32% of the 2040 total. China’s LNG imports tripled between 2010 and 2016, reaching 3.5 Bcfd (17% of total supply) in 2016. By 2018, China is projected to surpass South Korea as the world’s second-largest LNG importer. By 2040, China is expected to import about 11 Bcfd, as much as the world’s largest LNG importer, Japan.

China’s pipeline imports increased to 3.7 Bcfd in 2016, accounting for 19% of the total natural gas supply. Although the IEO2017 Reference Case expects China’s imports of natural gas by pipeline to rise in absolute terms to 7.3 Bcfd in 2040, their share of China’s total supply is projected to fall to 12% by that year. China began importing natural gas by pipeline from Turkmenistan in 2010 and has since begun importing natural gas from Uzbekistan, Kazakhstan, and Myanmar. EIA expects natural gas imports from Russia on the new 3.7 Bcfd Power of Siberia pipeline to begin in late 2019.

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- Trinity Gas Storage reaches FID on Phase II expansion

Comments