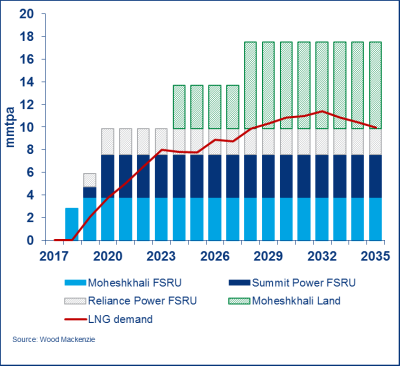

Woodmac: Bangladesh's LNG demand to rise to 8 MMtpy by early next decade

Last month, Bangladesh's state-owned oil company PetroBangla signed its first LNG import deal (2.5 MMtpy, 15 yr) with Qatar's RasGas, marking the country's official entrance into the LNG buyers' club.

|

| Courtesy of Wood Mackenzie. |

This deal should alleviate some of Bangladesh's supply shortages, but is a far cry from its LNG ambitions. Wood Mackenzie forecasts a more moderate LNG requirement of over 8 MMtpy by early next decade.

The government currently estimates LNG demand at around 5 MMt. However, due to the lack of domestic gas production, the government has stopped building gas pipelines and has been promoting the use of LPG in residential and commercial areas over the past few years.

On the other hand, while gas prices to all sectors have already increased twice in 2017 and averaging at around $3/MMBtu, it still falls short of international LNG prices, making it attractive for both retail and commercial users. Currently, there is also no firm plan on gas price rationalization.

These factors make the LNG import situation for Bangladesh more pressing.

PetroBangla is in talks with various parties for both long term and more flexible options for spot LNG deliveries. In June, it signed an MOU with AOT to supply up to 1.75 MMt of LNG. However, the deal is still under discussion and will be a part of its spot procurement strategy.

Conversations with key stakeholders indicate the Moheskhali FSRU, which will support its first LNG imports, remains on schedule to begin by the end of 2018. The onshore gas pipeline connecting the FSRU from Cox's Bazar to the main demand center in Chittagong has also been completed.

Plans are also under way to build a subsea pipeline from Moheskhali Island to the mainland gas valve. A $180 MM financing package with Excelerate for the Moheskhali FSRU has also been concluded.

With plans for another 17 MMtpy of planned regas capacity via FSRUs and an onshore LNG terminal, the government is clearly in support to boost its LNG supply. Already, private capital is being attracted to this sector with the involvement of Summit Power, Reliance Power and Petronet who are looking to invest in these terminals.

Wood Mackenzie expects more upside to Bangladesh's LNG demand particularly if the 1.5 MMtpy Indian piped gas import gets delayed or cancelled, and if its coal-fired power plants do not come online as planned.

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- Trinity Gas Storage reaches FID on Phase II expansion

Comments