GTL Tech Forum '16: CEO says change needed to improve GTL cost feasibility

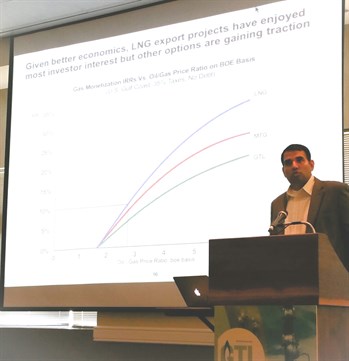

Uday Turaga, CEO of ADI Analytics. Dr. Turaga speaks about the impact of the oil/gas spread on GTL economics.

By Adrienne Blume, Editor of Gas Processing and Executive Editor of Hydrocarbon Processing

Opening the second day of Gulf Publishing Company's GTL Technology Forum in Houston, Texas was Uday Turaga, CEO of ADI Analytics. Dr. Turaga spoke about the impact of the oil/gas spread on GTL economics.

Historical gas supply and demand. The growing supply of cheap natural gas has been driving interest in LNG exports, Turaga noted. By 2030, the global gas supply will expand to 90 Bcfd (at minimum) to 135 Bcfd (at the upper range) from 70 Bcfd in 2014. The significant supply of natural gas in North America is compelling; however, demand is growing "far too slowly," Turaga said.

"What we see is that over the last 15 years, gas demand has actually declined on a relative basis," he said. Industrial gas demand grew just 3.4% between 2010 and 2015, to 20.6 Bcfd, vs. demand of 22.3 Bcfd in 2000. Residential gas demand saw an even-smaller 0.3% growth between 2010 and 2015, to 13.3 Bcfd, also down from 13.7 Bcfd in 2000. Meanwhile, power demand saw the greatest growth of 5.9% between 2010 and 2015, to 26.6 Bcfd, vs. 14.3 Bcfd in 2000.

GTL economics. "At some point, [the gas market] needs to compete with the extremely efficient coal-fired generation capacity that's out there," Turaga acknowledged. "We could get 5% to 10% [of the coal-fired power market share] at some point in the future, but it will be difficult to replace much more than that."

Producers are looking for different ways to monetize their natural gas streams. The distributed resource base among shale plays will help these efforts. It may be feasible to justify the construction of a gas processing plant in one area of the country—for example, the Marcellus region—over another, such as the Gulf Coast.

Price impacts on project costs. Barring supply outages and geopolitics, cost and economic fundamentals suggest a "lower for longer" outlook for oil prices, Turaga said. Oil price volatility on a weekly or monthly basis is due to factors that are hard to model, such as weather, natural disasters, etc.

Operators are continuing to eke out returns from existing assets in key unconventional plays, while drilling and completion costs have decreased.

"The biggest challenge with GTL continues to be capital costs," Turaga said. The rate of return for GTL in terms of gas monetized vs. CAPEX is still lower than the returns seen for LNG and MTG. High costs for syngas (30% of total cost) and the FT unit (28% of total cost) are prohibitive at present.

In recent years, however, methanol plants have grown in size, enabling economies of scale and low capital costs. Small-scale methanol projects continue to be attractive.

"If you look at the projects that are moving forward, you'll see that more companies have actually set up projects in small-scale methanol than in classic GTL," Turaga noted.

Enhancing GTL viability. Turaga acknowledged that GTL can be competitive with the right mix of components, including commercial structures, integrated projects, cross-owned JVs, contracts with upside sharing and ownership by all stakeholders.

Capital cost efficiency can be improved with small projects, modular plants, disciplined EPC works, brownfield plants and co-location of projects. Operating cost reductions can be achieved with brownfield and co-located facilities. Small-scale GTL can also help address flaring in areas like the Bakken and Eagle Ford shales.

In general, creative project structuring can enable the improved competitiveness of GTL projects, Turaga said.

The fifth annual GTL Technology Forum will take place in summer 2017 in Houston. For more coverage of the 2016 GTL Tech Forum, please click here.

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

- Trinity Gas Storage reaches FID on Phase II expansion

Comments