Global pipelines construction outlook 2024: New LNG terminals sound call for more pipelines—Part 1

M. REED, Pipeline & Gas Journal, Houston, Texas

Note: This article originally appeared in Gas Processing & LNG’s sister publication Pipeline & Gas Journal within the January 2024 issue.

It comes as little surprise to those in the midstream industry that during the past year we have continued to see LNG initiatives garner more attention than pipeline projects. However, terminal construction drives new pipeline construction.

While this is increasingly true in Europe, where new pipelines are being developed to support new entry-points for gas, it is also true in the U.S., where new pipelines are needed to supply the liquefaction plants on the other side of the LNG supply chain. As LNG infrastructure continues to develop, pipeline construction will grow with it.

Similarly, thousands of miles of hydrogen (H2) pipelines are in development, particularly in Europe, as the drive toward net-zero energy matures, and H2 finds a bigger role in the energy mix. This will bring additional opportunities for pipeline construction and related work, as well.

In fact, traditional pipeline construction remains strong, particularly in new gas markets. India has remained strong among global pipeline construction as it expands gas access to hundreds of millions of people. Argentina is also transforming its relationship to energy as it develops its shale resources. There is still plenty of space to develop fossil fuel pipelines.

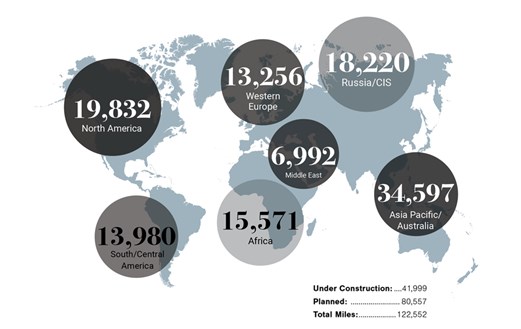

At the beginning of this year, Pipeline & Gas Journal reported a total of 41,999 mi of pipeline under construction. Another 80,557 mi of pipeline are in the planning stages, reaching a combined total of 122,556 mi worldwide (FIG. 1). Overall that figure represented a 9.3% increase worldwide over the previous year.

FIG. 1. There are more than 122,000 mi of natural gas pipelines under development worldwide.

Globally, Indian and Chinese pipeline development continues to drive growth, with those countries containing around a quarter of planned and under-construction pipelines.

As in recent years, activity in global pipeline construction markets will continue to be bolstered by natural gas, with Europe still looking for additional sources to replace Russian supplies, and the Asia-Pacific region continuing to expand its import, transmission and distribution infrastructure, led by India and China.

NORTH AMERICA

Pipelines under construction: 8,689 mi

Pipelines planned: 11,143 mi

Total: 19,832 mi

North America is still developing as a major global supplier of LNG through growing shipments from the U.S. Gulf Coast to Europe. Unfortunately, from the midstream perspective, pipeline construction to support future LNG expansions has been limited by a variety of factors.

Natural gas production growth in the Marcellus and Utica shale plays remains restricted due to pipeline bottlenecks from the region. Also, pipelines delivering Permian Basin and Haynesville gas to the U.S. Gulf Coast are catching up with near-term demand. Still, Pipeline & Gas Journal’s forecast for North America indicates a total of 19,832 mi of pipeline either planned or under construction in the region.

Of that total, nearly 8,700 mi are under construction, which is more than a year ago. Planned project mileage also rose to 11,043. Overall, this represents a 9.5% increase from last year.

In the U.S., more than 8 Bft3d of pipeline capacity is either planned or under construction from the Permian and Haynesville basins as pipeline operators jockey for position around LNG growth markets on the Texas and Louisiana Gulf coasts.

Complementing these efforts, an ongoing wave of acquisitions is making some of the biggest midstream players even bigger while embedding them more deeply in both production and demand markets.

Some of those acquisitions are expansions of gathering and processing footprints to support existing long-haul business. Others are aimed at positioning companies to capitalize on LNG demand growth, which requires that operators move ahead of the demand.

While much of the new capacity is a couple of years from becoming reality, the demand is there and must be supported by new natural gas pipeline projects. These projects range from new and expanded gathering systems, long-haul pipe construction, compression expansions and so-called “last mile” pipe connecting large transmission systems to specific areas and facilities.

While the timelines for LNG expansion can be fickle—the underutilization of new pipelines is common—the effect of those gaps will vary. For example, Energy Transfer has already finished construction of the 1.65-Bft3d Gulf Run pipeline to move gas from north Louisiana to the coast. That project—gained through the acquisition of Enable Midstream in December 2021—is backed by a 20-yr agreement with the $10-B Golden Pass LNG export plant now under construction in Texas by QatarEnergy (70%) and ExxonMobil (30%).

The Permian Basin. While most of the Permian Basin natural gas pipelines build-out in recent years has targeted LNG export markets to the south of the Houston area, two proposed intrastate projects have emerged within the last couple of years that will deliver Permian Basin gas to the Texas-Louisiana border region.

The larger of the two—Targa’s 562-mi Apex pipeline—was approved by the Railroad Commission of Texas in late March 2023. The pipeline originates in Midland County in West Texas to Jefferson County, along the Louisiana border near Sabine Pass.

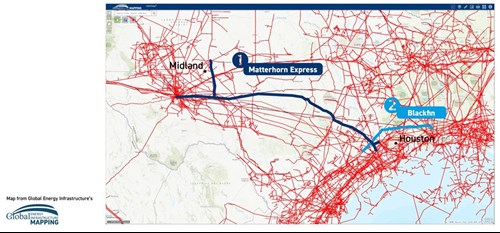

WhiteWater Midstream’s proposed 190-mi Blackfin Pipeline, which filed for state regulatory approval in February 2023, takes a different approach. Although Blackfin would originate at the eastern edge of the Eagle Ford shale, it would primarily serve as an extension of the 580-mi Matterhorn Express Pipeline (FIG. 2) that was sanctioned in May 2022 by a JV of WhiteWater, EnLink Midstream, Devon Energy and MPLX.

FIG. 2. View of the Matterhorn Express and Blackfin pipelines in Texas. Source: The Global Energy Infrastructure (GEI) database.

Additionally, the Matterhorn Express is scheduled to be in service in Q3 of this year and will provide 2 Bft3d–2.5 Bft3d of Permian takeaway capacity to the Katy area west of Houston. Blackfin would link with Matterhorn to help debottleneck the Katy area and, like Apex, deliver volumes east to the Texas-Louisiana border area.

These Permian connectivity projects will be obtaining pipe closer to the LNG liquefaction projects than some past projects, such as Gulf Coast Express, Permian Highway and Whistler.

The Haynesville Basin. Several natural gas pipeline projects are in development to connect Haynesville gas producers to U.S. Gulf Coast LNG exporters (FIG. 3).

FIG. 3. Several natural gas pipeline projects are in development to connect Haynesville gas producers to U.S. Gulf Coast LNG exporters. Source: The Global Energy Infrastructure (GEI) database.

One major project is DT Midstream’s three-stage Louisiana Energy Access Pipeline (LEAP) expansion. The existing LEAP Gathering Lateral Pipeline is a 155-mi, 1-Bft3d line stretching from the Haynesville basin to the U.S. Gulf Coast region. DT midstream plans to increase LEAP’s capacity by 90% through compression and construction expansions to 1.9 Bft3d.

The first stage of the expansion would add 300 MMft3d of capacity, which is expected to be completed by the end of this year. Stage 2 will add an additional 400 MMft3d of capacity, with operations scheduled to begin in Q1 2024. The final stage would add 200 MMft3d, with completion set for Q3 2024.

Momentum Midstream is developing the New Generation Gas Gathering project (dubbed NG3) from the Haynesville region to coastal Louisiana LNG markets, with 275 mi of additional natural gas gathering pipelines with 2.2 Bft3d of capacity. The system will be complemented with a carbon capture and sequestration (CCS) solution to offer producers a net negative carbon dioxide (CO2) emissions solution. NG3 is expected to be completed in 2024.

Additionally, Williams announced in May 2022 that it was committing about $1.5 B to expand natural gas capacity and grow market access. The company followed up a month later by sanctioning its Louisiana Energy Gateway (LEG) project, which is designed to move 1.8 Bft3d of Haynesville natural gas to several U.S. Gulf Coast markets. Tulsa-based Williams expects startup of the LEG system by 2024.

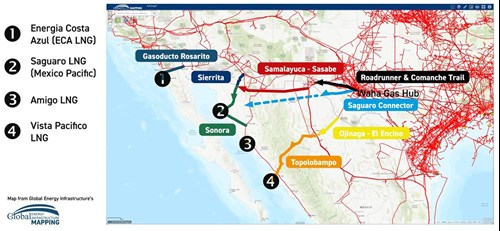

Further to the south, Mexico is developing 31 MMtpy of LNG export capacity on its west coast. Unusual for an LNG exporter, these projects are looking to import most of their feed gas. That is welcome news for U.S. natural gas producers, which stand to gain easier access to Asian markets, as well as pipeline operators that deliver their gas to the border and planned export terminals.

Most of the terminals will make use of spare capacity on existing pipelines, including the Sonora pipeline, the Topolobampo pipeline and the Samalayuca–Sasabe pipeline (FIG. 4), with gas originating at the Waha gas hub via either the El Paso Pipeline System or the Comanche Trail and Roadrunner Gas Transmission pipelines.

FIG. 4. Gas supplies for Mexican LNG export terminals. Source: The Global Energy Infrastructure (GEI) database.

The biggest potential new project is the Saguaro Connector Pipeline. The pipeline will deliver natural gas to Mexico Pacific’s 14.1-MMtpy Saguaro LNG export facility on the coast of the Gulf of California. In December 2022, a division of Tulsa-based ONEOK filed an application with the U.S. Federal Energy Regulatory Commission (FERC) to construct the 155-mi pipeline that would run from the Permian Basin to Mexico.

The 48-in., 2.8-Bft3d pipeline would run to the border and interconnect with a planned Mexican pipeline that would continue to Mexico Pacific’s LNG terminal. However, no details of the Mexican route are available.

Coastal GasLink. In Canada, one of the biggest positive developments for energy infrastructure developers in recent years has been that the country’s First Nations people are beginning to embrace the economic opportunities that pipeline and export projects can offer. The growing technical and financial participation by First Nations people represent a sea change in the relationship between Canada’s indigenous leadership and midstream projects that has been years in the making.

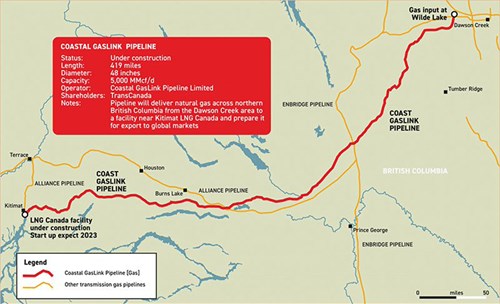

One of the clearest indications of that evolving perspective was the creation of the First Nations Major Projects Coalition (FNMPC) in 2016, a coalition of more than 130 of Canada’s First Nations communities that have committed to work toward economic advancement through such projects as TC Energy’s Coastal GasLink pipeline (FIG. 5).

FIG. 5. View of the Coastal GasLink pipeline. Source: The Global Energy Infrastructure (GEI) database.

In an early success, the coalition was instrumental in helping First Nations members reach an agreement to take a 10% ownership stake in the Coastal GasLink pipeline project, which TC Energy completed construction in October 2023.

The Coastal GasLink project involves the construction and operation of a 48-in., 416-mi pipeline from near the community of Groundbirch in northeastern British Columbia to the Shell-led LNG Canada export terminal near Kitimat, British Columbia. From there, the LNG will be exported to Asian markets, helping to reduce emissions by replacing high-carbon coal. The Coastal GasLink pipeline can move 2.1 Bft3d of natural gas with the potential for delivery of up to 5 Bft3d, depending on the number of compressors and meter facilities constructed.

In another sign of growing First Nations involvement, indigenous groups—including Project Reconciliation, Nesika Services and Chinook Pathways—are contenders for an ownership stake in Canada’s other major pipeline project slated for mechanical completion by the end of the year: the expansion of the Trans Mountain (TMX) pipeline and related export facilities. The project involves the twinning of an existing 715-mi pipeline originating near Edmonton, Alberta, and extending to Burnaby, British Columbia.

The 590,000-bpd expansion will nearly triple the flow from Alberta’s oil sands to Canada’s Pacific coast, opening access to Asian markets. It includes more than 600 mi of new 36-in. pipe and 120 mi of reactivated pipeline, along with 12 new pump stations and 19 new storage tanks at existing terminals.

While the First Nations have continued to express interest in acquiring a stake in the project, potentially with Pembina, mounting costs for the project have raised concerns about a suitable return on the investment. Trans Mountain expected to start filling the pipeline months ago, but has once again run into a construction-related hurdle that could delay its completion by 10 mos.

Also in Canada, Keyera Corp. completed the Key Access Pipeline System (KAPS), a 357-mi natural gas liquids (NGL) and condensate pipeline. It will transport 350,000 bpd of NGL and condensate from the Montney and Duvernay basins to Keyera’s processing hub in Alberta's Industrial Heartland, Fort Saskatchewan. The pipeline will consist of a 16-in. pipeline for condensate and a 12-in. pipeline for an NGL mix.

CENTRAL AND SOUTH AMERICA/CARIBBEAN

Pipelines under construction: 4,507 mi

Pipelines planned: 9,473 mi

Total: 13,980 mi

South America is an active region for pipeline development with more than 13,980 mi of pipeline planned or under construction. The biggest milestone for South American pipelines this year was the completion of the first stage of the Nestor Kirchner pipeline in Argentina (FIG. 6).

FIG. 6. View of the Nestor Kirchner, Gasducto Norte and Reversion del Norte pipelines. Source: The Global Energy Infrastructure (GEI) database.

The pipeline will bring to market Argentina’s Vaca Muerta shale gas. Located in the west of Argentina, the Vaca Muerta reservoir is estimated to hold 300 Tft3 of recoverable gas reserves. Argentina is now a net importer of gas, but development of the reservoir promises to satisfy the country’s domestic demand and leave a large surplus available for export.

The Nestor Kirchner pipeline began development in 2018 and the first phase of the project—a 290-mi section of 36-in. pipe—was opened in mid-2023. The pipeline will eventually operate at a capacity of 6.6 Bft3d.

This first section links Vaca Muerta production to the Buenos Aires province where most of Argentina’s domestic gas demand is located. The second section of the project will carry gas farther north to the Santa Fe province where it can supply customers in northern Argentina.

As part of the project, Argentina is also reversing the flow of the Northern Pipeline, currently set up to receive gas from Bolivia. Bolivian gas production is falling, and Bolivia and Brazil are both potential markets for Argentinean gas.

Combined with the flow reversal, a 93-mi interconnector between the Northern Pipeline and the Central East Pipeline will ensure additional Vaca Muerta gas has a route north to Argentina’s neighbors.

Construction on the second phase of the pipeline has yet to begin. State-owned Energia Argentina is expected to launch tenders for its construction, and it is hoped the second phase will be completed before the end of this year.

Part 2. Part 2—to be featured in the June issue—will detail pipeline construction in Africa, Asia, Europe, Russia and the Commonwealth of Independent States, and the Middle East.

ABOUT THE AUTHOR

Mike Reed is the Editor-in-Chief of Pipeline & Gas Journal, a sister publication of Gas Processing & LNG. He has been with the publication for 12 yr. Prior to his current role, he worked as a journalist with Houston Community Newspapers and The Houston Post. Reed earned a Bch degree in journalism from Southern Illinois University-Carbondale.

Comments